What is Term Insurance? The Financial Safety Net Most Indians Ignore

In India, the idea of financially securing our family has always been important. Whether it’s through gold, property, or savings, every family tries to plan for the future. But there is one tool that often gets missed. Despite being very powerful and affordable, most of us tend to ignore term insurance. Now, what is Term Insurance?

Let’s learn the basics!

What is Term Insurance?

Term insurance is a type of life insurance that offers financial protection for a specific “term” (like 10, 20, or 30 years). If the policyholder (you) passes away during this term, your family (nominee) gets a lump sum amount, called the sum assured.

If the policyholder survives the policy term, no money is paid in most basic term plans. This is why term insurance is also called a pure protection plan. It is designed only to protect your loved ones if something unexpected happens to you.

Unlike other insurance plans, term insurance focuses only on life cover. It doesn’t have any savings or investment part. That’s why the premium is lower, making it affordable for most people.

You can also add extra features (called riders) like critical illness cover, accidental death cover, and more.

Term insurance protects your future—grow it too with the best investment app.

Eligibility and Documents Required for Term Insurance

If you’re thinking about buying term insurance for the first time, here’s what you need to know.

Most insurance companies require you to be between 18 and 65 years old to be eligible. Some may also look at your job or health before approving your application.

To get started, you’ll need a few basic documents like your ID proof (Aadhar or PAN card), address proof, and income proof. You’ll also need to complete the KYC process.

Sometimes, especially if you’re older or your health needs a closer look, the insurer might ask you to do a medical test.

Types of Term Insurance Plans in India

There are different kinds of term plans available in the market today. Each one is designed to meet specific goals:

1. Level Term Plan

This is the most basic type. The sum assured stays the same throughout the policy term. It is affordable.

2. Increasing Term Plan

In this plan, the sum assured increases every year. It helps your policy keep up with rising costs (inflation). For example, the cover might go up by 5% or 10% each year.

3. Decreasing Term Plan

Here, the sum assured goes down every year. This type is suitable when your financial responsibilities (like home loan or education loan) decrease over time.

4. Return of Premium Term Plan

If you survive the policy term, all the premiums you paid are returned to you. These plans cost more but offer some return at the end.

5. Convertible Term Plan

You start with a term plan and later convert it into a different type of life insurance (like endowment or whole life policy) without any medical tests.

6. TROP (Term Return of Premium)

Herein, you can get the premiums paid if you survive, but these are more expensive and give no extra benefits.

How Does Term Insurance Work?

Here’s a step-by-step breakdown of how a term plan works:

1. First, you need to decide how much money you would like to secure or invest for your family in your absence. Based on your age, income, and family’s future needs, choose the sum assured and term duration.

2. You can choose to pay yearly, half-yearly, quarterly, or monthly. Make sure payments are made on time to keep the policy active.

3. Next, you need to nominate a family member. This is the person who will receive the sum assured in case of your death. It’s usually a spouse, parent, or child.

4. In case of death, the nominee must submit a death claim to the insurance company. After document verification, the insurer pays the sum assured.

5. In case you survive the term, no money is paid. But if you’ve chosen a Return of Premium plan, you’ll get back the premiums you paid.

Benefits of Term Insurance in India

Here are various reasons as to why term insurance is important for all:

1. High Coverage at an Affordable Premium

Term insurance offers a large life cover at a comparatively low premium. A person can secure coverage of ₹1 crore or more by paying a premium ranging from ₹500 to ₹800 per month, depending on their age, health condition, and lifestyle habits.

As per LIC India, the Tech Term Plan provides ₹1 crore life cover starting at ₹3,000 per quarter for salaried individuals.

2. Financial Security for Family

In the event of the policyholder’s death during the policy term, the nominee (usually a family member) receives a lump sum amount, known as the death benefit. This amount is tax-free and can help the family:

- Repay outstanding loans or liabilities

- Manage children’s education expenses

- Cover day-to-day household costs

- Fund long-term family goals such as marriage or property purchase

Term insurance ensures that the family’s standard of living is not compromised during difficult times.

3. Tax Benefits

Term insurance provides tax savings under the Indian Income Tax Act:

- Section 80C: Premiums paid for term insurance are eligible for tax deductions up to ₹1.5 lakh per year

- Section 10(10D): The death benefit received by the nominee is fully exempt from tax

These tax benefits make term insurance a financially efficient choice for long-term planning.

4. Add Riders for Extended Coverage

Riders are optional benefits that can be added to a term insurance policy for enhanced protection. These riders cover specific events and risks, including:

- Critical Illness Rider: Offers a lump sum if diagnosed with listed critical illnesses such as cancer or heart attack

- Accidental Death Benefit Rider: Provides additional payout in case of death due to an accident

- Waiver of Premium on Disability Rider: Herein, the future premiums are waived if the policyholder becomes permanently disabled

5. Flexible Premium Payment Options

Term insurance offers flexibility in premium payments. Policyholders can choose how they want to pay the premium:

- Monthly

- Quarterly

- Annually

- Single premium (one-time payment)

Some plans also offer limited pay options, where the premiums are paid for a few years, but the coverage continues for the entire policy term.

6. Easy and Transparent Online Purchase

Most insurance providers offer term insurance policies online. This allows you to compare different plans, check premium quotes, and purchase the policy.

Online policies often come at a lower premium cost as they do not involve commission or agent fees. Additionally, the documentation and claim process is more transparent and trackable.

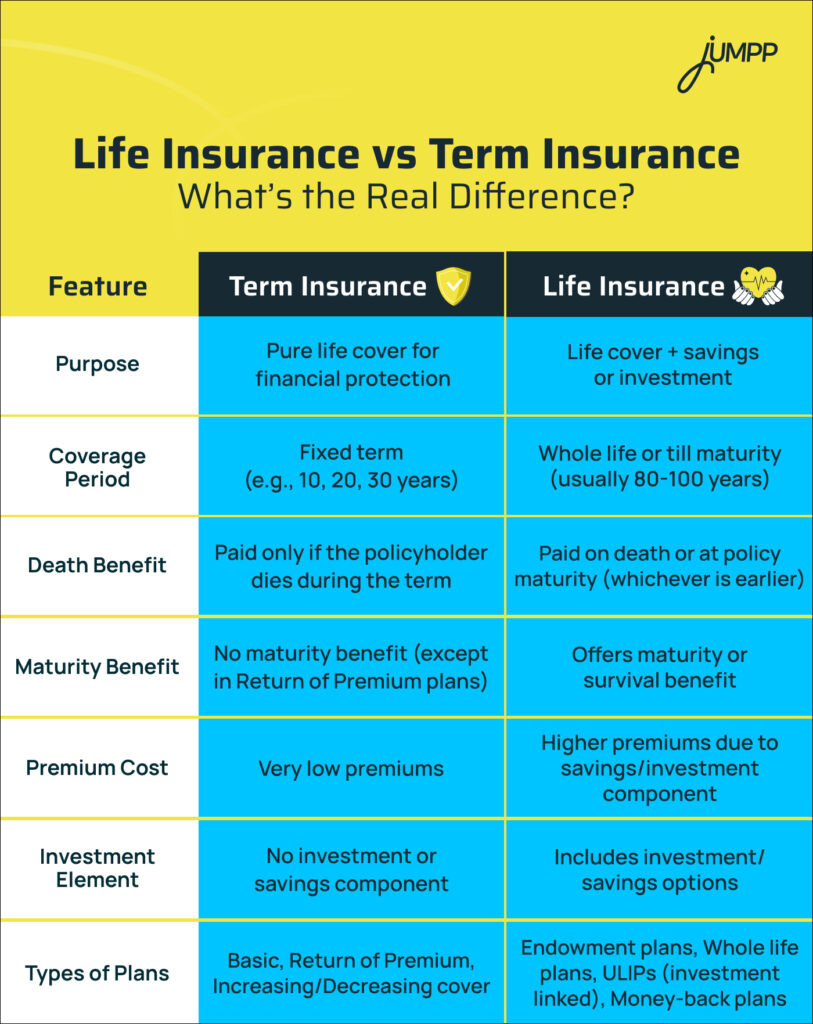

Term Plan vs Life Insurance: What’s the Difference?

Many people use the words term plan and life insurance like they mean the same thing. But actually, they are a bit different. Understanding these differences can help you pick the right plan for your family’s future.

Life Insurance vs Term Insurance: What’s the Real Difference?

What is a Term Plan?

- A term plan is a type of life insurance that gives you pure protection.

- It only pays a fixed amount (sum assured) to your family if something happens to you during the policy period.

- If you survive the policy term, you don’t get any money back.

- Because it’s simple and just for protection, the premium (money you pay) is usually very low.

What is Life Insurance?

- Life insurance is a broader term that includes term plans but also other types of plans.

- Some life insurance plans give you protection plus a way to save or invest money. These are called endowment plans, money-back plans, or ULIPs.

- These plans pay money to your family if you die, and they may also give you some returns if you live through the policy term.

- Because these plans have a saving or investment part, their premiums are higher.

- Life insurance can be seen as a combo of protection and savings.

Life Insurance vs Term Insurance- Which One Should You Choose?

- If your main goal is to secure your family financially at a low cost, a term plan is the best choice.

- If you want a plan that also helps you save money over time, and you don’t mind paying higher premiums, then traditional life insurance plans can work.

- Many financial experts suggest buying a term plan first for protection, and then investing separately for savings.

In simple words:

Term plan = life cover only.

Life insurance = life cover + savings/investment.

Conclusion

In simple words, term insurance is a financial safety net. It is not an investment; it is a responsibility.

Every earning person, whether salaried or self-employed, should think of term insurance as a basic financial tool. It ensures that even in your absence, your family doesn’t have to struggle.

It is affordable, flexible, and can be customized as per your needs. In a country like India, where the financial burden usually falls on one or two family members, term insurance is not a luxury. It is a need.

Term Insurance Meaning: FAQs

A term plan is simply the insurance product you purchase under term insurance. It is one of the simplest forms of life insurance and is focused on giving your family a large financial cover at a low premium cost.

The policy term means the number of years your insurance plan will stay active.

You can choose a policy term based on your need, like 10, 20, 30, or even up to 99 years.

These are insurance policies where you pay a fixed amount regularly, and your family gets money if something happens to you.

Term plan ek aisa beema plan hai jo sirf ek fixed time ke liye cover deta hai, aur death hone par paisa milta hai.

The premium paying term is the number of years during which you will have to pay the insurance premium. There are three types of premium paying options: Regular Pay, Limited Pay and Single Pay.

You pay premiums regularly. If you die during the policy term, your nominee gets the sum assured.

Yes, you can buy more than one term insurance plan to increase your coverage or meet different financial goals.

Usually, a basic medical test is needed, but some insurers offer policies without medical exams for certain age groups or coverage amounts.

Yes, you can purchase multiple-term insurance plans from different insurance companies. However, insurers may consider your existing coverage when assessing new applications.

A medical test is usually required for term insurance, particularly for high coverage amounts.