What is a ULIP Plan? Full Form, Lock-in Period, Tax Rules and More

When it comes to managing money, Indians have always struck a balance between two key factors, i.e. security and growth. That’s why people are now exploring Unit Linked Insurance Plan (ULIP) for long-term financial planning. But what is ULIP, and how does it work? And is it a good investment for you?

Let’s uncover it all!

ULIP Full Form and Meaning

The ULIP full form is Unit Linked Insurance Plan.

In simple terms, ULIP is a combo of insurance and investment. When you pay a premium towards a ULIP, a part of it goes towards your life insurance cover, and the remaining is invested in market-linked instruments like equity funds, debt funds, or a mix of both.

If you pay ₹1 lakh annually for a ULIP policy:

- Around ₹10,000 to ₹20,000 might go towards your life insurance

- The remaining ₹80,000 to ₹90,000 will be invested to earn market returns

What Is ULIP Insurance? How Does It Work?

A ULIP insurance plan works like this:

- You choose your sum assured (life cover) and investment type (equity, debt, or hybrid).

- You pay regular premiums (monthly, yearly, or single).

- FMC charges in ULIP, also known as fund management charges, are taken monthly and impact your final returns.

- The insurance company deducts various charges (more on this later).

- The rest is invested in units of a chosen fund. These units are linked to market NAVs (Net Asset Value).

- Over time, the value of your fund grows or falls depending on market performance.

- On maturity, you receive the fund value, and in case of untimely death, your family gets the higher of the sum assured or fund value

So, ULIP meaning reflects a strategy where your wealth creation goals and family protection goals are bundled into one financial instrument.

If you’re someone who wants to grow money with market exposure but also wants to ensure financial security for your family, ULIP offers a unique two-in-one advantage.

Types of ULIPs

1. Based on Where Your Money is Invested

- Equity ULIPs

These ULIPs invest mostly in shares and equity-related funds. They offer the potential for high growth but also come with higher risk. These are better suited for investors who are comfortable with market ups and downs and are looking for long-term gains.

- Debt ULIPs

These plans invest in safer options like government securities, bonds, and fixed-income instruments. They offer lower but more stable returns and are preferred by people who want more predictability with less market exposure.

- Balanced ULIPs

As the name suggests, these strike a middle path. A part of your money goes into equity for growth, and the rest is parked in debt to reduce risk. It’s a mix that works well if you want to grow your wealth but also protect it from major market swings.

2. Based on How You Pay the Premium

- Single Premium ULIPs

These are one-time investment plans. You pay a lump sum at the beginning, and the policy continues for the chosen term. It’s useful for people who want to invest a large amount at once without worrying about future payments.

- Regular Premium ULIPs

These plans allow you to pay premiums over time—monthly, quarterly, or annually. It gives you more flexibility and helps build a habit of disciplined investing.

3. Based on Your Financial Goals

- Child ULIPs

These are designed to help you save for your child’s future. The money can be timed for major milestones like school admissions or college fees. Some even come with features that ensure the plan continues even if the parent is no longer around.

- Retirement ULIPs

These plans are built for creating a retirement fund. They allow you to build a corpus during your earning years, and at maturity, you can withdraw a part of it and use the rest to buy a pension plan or annuity.

- Wealth Creation ULIPs

These are general-purpose ULIPs for long-term wealth creation. People use them to save for goals like buying a house, planning a wedding, or building an emergency fund.

- Health Benefit ULIPs

These offer investment benefits along with some level of health protection, such as critical illness cover. It’s a way to grow your money while also covering certain medical risks.

4. Other Ways ULIPs Are Categorised

- ULIPs with or without guarantees

Some ULIPs promise a minimum return or capital protection, while others are fully market-linked with no guaranteed amount. Guaranteed ULIPs usually come with higher charges.

- Type 1 vs Type 2 ULIPs

This classification refers to how the insurance payout is made in case of death.

- Type 1 pays either the sum assured or the fund value, whichever is higher.

- Type 2 pays both the sum assured and the fund value, making it more suitable for people looking for higher financial security for their family.

ULIPs are flexible and can be tailored to fit your needs. Whether you’re saving for a goal, building wealth, or securing your family’s future, there’s likely a ULIP type that fits your journey.

The key is to match your risk comfort and financial goal with the right ULIP structure.

Want to understand how ULIPs compare with traditional policies? Learn more in our guide on what is life insurance.

ULIP Advantages and Disadvantages

| ULIP Advantages | ULIP Disadvantages |

| 1. Dual Benefit: Combines insurance and investment in one plan | 1. Lock-in Period: Your money is locked in for 5 years, no early exit allowed |

| 2. Tax Savings: Premiums qualify under Section 80C, and returns may be tax-free under 10(10D) | 2. Charges Can Be High: Includes allocation, mortality, and fund management charges |

| 3. Market Returns: Offers growth potential through equity and debt funds | 3. Returns Not Guaranteed: Linked to market performance, so returns can vary |

| 4. Fund Switching: Allows switching between equity and debt funds | 4. Complexity: Can be confusing to beginners due to multiple charges and fund choices |

| 5. Goal-Based Investing: Ideal for long-term goals like education or retirement | 5. Less Liquidity: Partial withdrawals allowed only after 5 years |

| 6. Transparency: You can track NAV and see exactly how your money is used | 6. Not Meant for Short-Term Goals: Works best only if you stay invested long-term |

Must-Know ULIP Benefits

Here are the must-know ULIP benefits that you must know before you invest in these!

1. Dual Benefit of Investment and Insurance

This is the most important feature of a ULIP. It gives you two benefits in a single plan.

One part of your money goes into life insurance, which protects your family financially if something happens to you. The other part is invested in market-linked funds such as equity, debt, or a mix of both. So, you are not just saving or investing. You are doing both with one product.

2. Long-Term Wealth Creation

ULIPs are designed for long-term goals. Because your money is invested in market-linked funds, it has the potential to grow over time. The longer you stay invested, the more you benefit from compounding returns.

ULIPs are not short-term instruments. They work best when you commit to them for 10 to 15 years.

3. Tax Benefits Under Sections 80C and 10(10D)

When you invest in a ULIP, you can claim tax deductions up to ₹1.5 lakh under Section 80C of the Income Tax Act. That means your taxable income comes down, and you save money legally.

Also, the maturity amount you receive at the end of the policy is tax-free under Section 10(10D), as long as certain conditions are met.

So you not only earn returns but also save tax on both the investment and the returns.

4. Flexible Fund Switching Option

ULIPs allow you to switch between different types of funds—like equity, debt, or balanced—based on your risk appetite or market conditions. This switching is usually free a few times each year.

5. Transparent and Trackable Investment

With a ULIP, you can track the Net Asset Value (NAV) of your fund just like in a mutual fund. You know exactly how much of your premium is going where—how much is spent on charges, how much is invested, and how your fund is performing.

This transparency builds trust and makes you more involved in your financial planning journey.

6. Disciplined Investing with Lock-in Period

ULIPs’ lock-in period is 5 years. This might feel restrictive at first, but it actually helps you stay disciplined. Most people withdraw money early due to fear or greed. ULIPs stop that habit.

This five-year lock-in period helps you avoid emotional decisions and lets your investments grow properly. After the lock-in, you can make partial withdrawals if needed.

7. Goal-Based Planning with Customisation

ULIPs can be used to plan for specific life goals. You can choose the policy term, the fund type, the premium amount, and even top up your investment if your income increases over time.

Some ULIPs also allow automatic fund allocation based on your age or goal. This makes it easier to stay aligned with your long-term objectives.

Mortality Charges in ULIP: Are They High?

Yes, ULIPs come with mortality charges, which are the cost of life insurance coverage embedded within the plan.

For example:

- A 30-year-old with a ULIP sum assured of ₹10 lakh might pay ₹2,000–₹5,000 annually just as mortality charges.

- These are deducted monthly from your fund value.

In recent years, however, zero-cost ULIPs or low-cost ULIPs have emerged, especially from newer digital insurers, reducing this burden considerably.

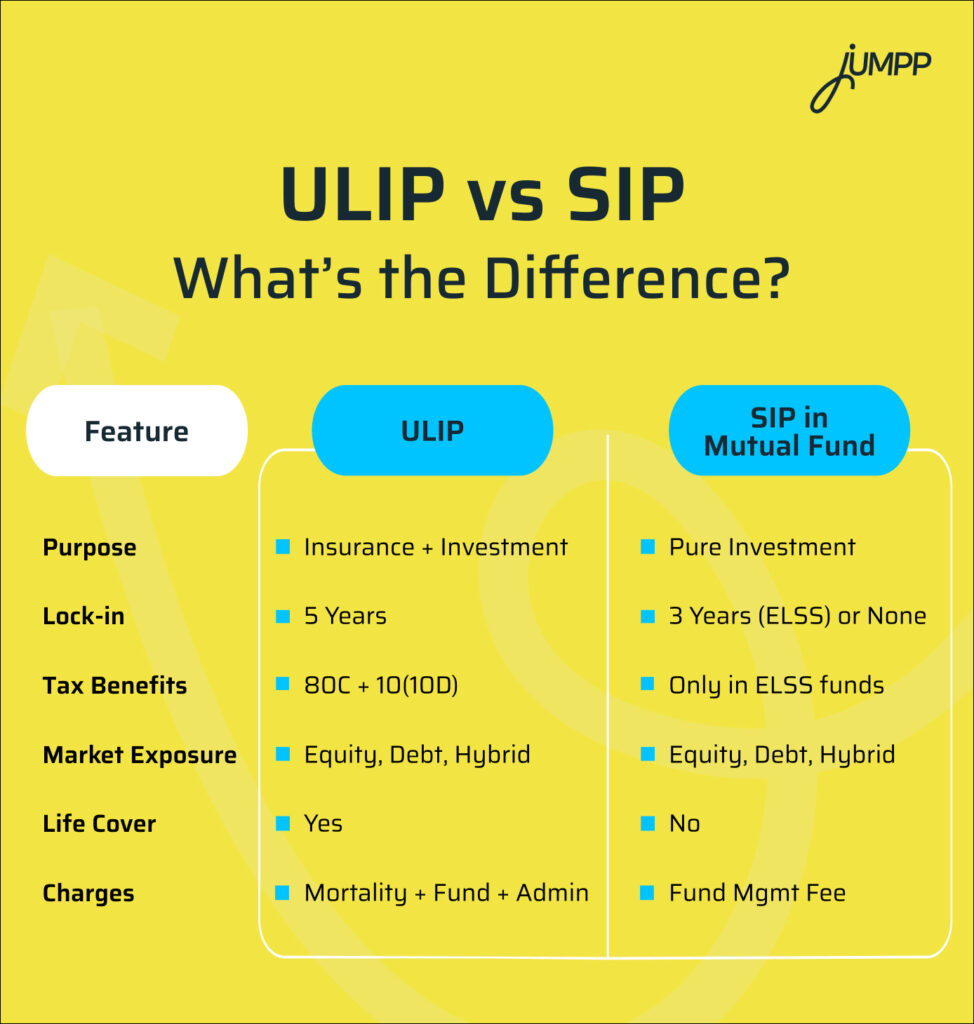

ULIP vs SIP: What’s the Difference?

This is a question many Indian investors ask: ULIP vs SIP – which is better?

SIP is great for those who want pure investment returns, flexibility, and liquidity.

ULIP is better suited for investors who want market participation with a protection layer and are ready for a long-term commitment.

Start investing in ULIPs, SIPs, mutual funds, stocks, bonds & more—get started with our Investment App

Difference Between ULIP and Mutual Fund

A mutual fund only invests your money, while a ULIP also gives you life insurance.

Let’s say:

- You invest ₹1 lakh annually in a mutual fund. The entire amount is invested in the market.

- But in a ULIP, a part goes toward insurance, and the rest is invested.

Mutual funds are regulated by SEBI.

ULIPs are regulated by IRDAI.

ULIPs also have a longer lock-in, making them more suitable for disciplined investors with long-term horizons.

Who Should Consider ULIPs?

ULIPs are ideal for:

- Young professionals with long-term financial goals

- Parents planning for their child’s education

- Individuals who want to save tax while getting life cover

- Investors who are comfortable with market-linked risk

Common Myths About ULIPs

Myth 1: ULIPs are very expensive.

While older ULIPs had high charges, modern plans are much more cost-efficient, especially digital ULIPs.

Myth 2: ULIPs don’t give good returns.

Returns depend on fund performance and holding period. With a 10+ year horizon, many ULIPs have matched mutual fund performance.

Myth 3: ULIPs are complicated.

With digital dashboards, transparent fund switching, and real-time tracking, managing a ULIP is now as easy as handling a mutual fund SIP.

Conclusion: Should You Invest in ULIP?

If you’re looking for a disciplined, long-term investment that combines life cover and market participation, a ULIP can be a powerful tool in your portfolio.

But you must stay invested for at least 10-15 years to truly benefit from compounding and fund growth. And you must be clear: ULIPs are not short-term products or alternatives to pure term plans.

ULIPs serve a different purpose. And when chosen smartly, they can help Indian investors grow wealth with protection.

ULIPs- FAQs

ULIPs can be classified by investment type, payment mode, and goal. Some of the most common types include equity, debt, balanced, child, and retirement ULIPs.

In a Type 2 ULIP, your nominee gets both the sum assured and the fund value in case of death. This offers higher financial protection than Type 1.

The main charges are premium allocation, policy administration, fund management, mortality, and surrender or withdrawal charges. These vary by insurer and plan.

Most ULIPs offer 5 to 8 fund options, including equity, debt, and balanced choices. You can switch between them based on your risk and goals.

ULIP stands for Unit Linked Insurance Plan. It combines life insurance with investment in market-linked funds like equity or debt.

Yes, if you want long-term growth with life cover and tax benefits. It works best when you stay invested for 10 years or more.

ULIP has a 5-year lock-in, but 5 years is the bare minimum. You should ideally invest for 10 to 15 years to see strong returns.