What is Diversification in Investing: Meaning, Types, and Benefits

Most investors do not lose money because markets fall. They lose money because they rely too heavily on a single investment rather than diversifying.

So, exactly what is diversification?

Instead of relying on one winner, diversification builds stability into your strategy from the start.

When assets are uncorrelated, a decline in one may be offset by stability or gains in another. That balance is what helps smooth returns and protect your portfolio from sharp shocks.

Let’s understand the meaning in detail!

What Is Diversification in Investing?

Diversification’s meaning is simple. It refers to spreading your money across different assets to reduce the impact of any single investment on your portfolio.

In investing, allocating funds across equities, debt, gold, real estate, and international markets helps maintain an overall risk balance.

When one asset underperforms, another may remain stable or grow. That is how diversification helps manage volatility without sacrificing growth potential.

Diversified Portfolio Example

Here is a simple example of how a diversified portfolio allocation may look:

| Asset Class | Allocation | Purpose |

| Large-Cap Equity Funds | 40% | Long-term growth with relative stability |

| Mid/Small-Cap Stocks | 20% | Higher growth potential |

| Debt Instruments (Short-Term Bonds) | 20% | Stability and income |

| Gold / Commodity ETFs | 10% | Hedge against inflation and uncertainty |

| International Funds / Global ETFs | 10% | Geographic and currency diversification |

This type of allocation ensures your money is not tied to a single asset or region. If one area underperforms, the others may hold or grow, helping you manage overall risk.

Want to build a truly diversified portfolio? Invest in stocks, bonds, mutual funds, ETFs, and more with an all-in-one investment app!

Is Portfolio Diversification Really Important?

Yes, portfolio diversification reduces the impact of market volatility and risk by ensuring your money is not concentrated in a single investment or sector.

In investing, risk is broadly classified into two types:

- Unsystematic Risk: Company- or sector-specific risk, such as poor earnings, management failure, or industry slowdown. This risk can be reduced through diversification.

- Systematic Risk: Market-wide risk caused by inflation, interest rate changes, wars, or global recessions. This cannot be eliminated, but its impact can be balanced.

A diversified portfolio primarily minimises unsystematic risk while cushioning the impact of broader market shocks.

How Diversification Helps?

- Reduces company-specific losses if one stock performs poorly

- Balances sector exposure when one industry slows down

- Offsets asset-class volatility (equity vs debt vs gold)

- Stabilises long-term returns during uncertain markets

- Prevents overdependence on a single economy or geography

For example:

- If technology stocks decline, FMCG or healthcare stocks may remain stable.

- If equity markets correct sharply, gold or government bonds may hold value or appreciate.

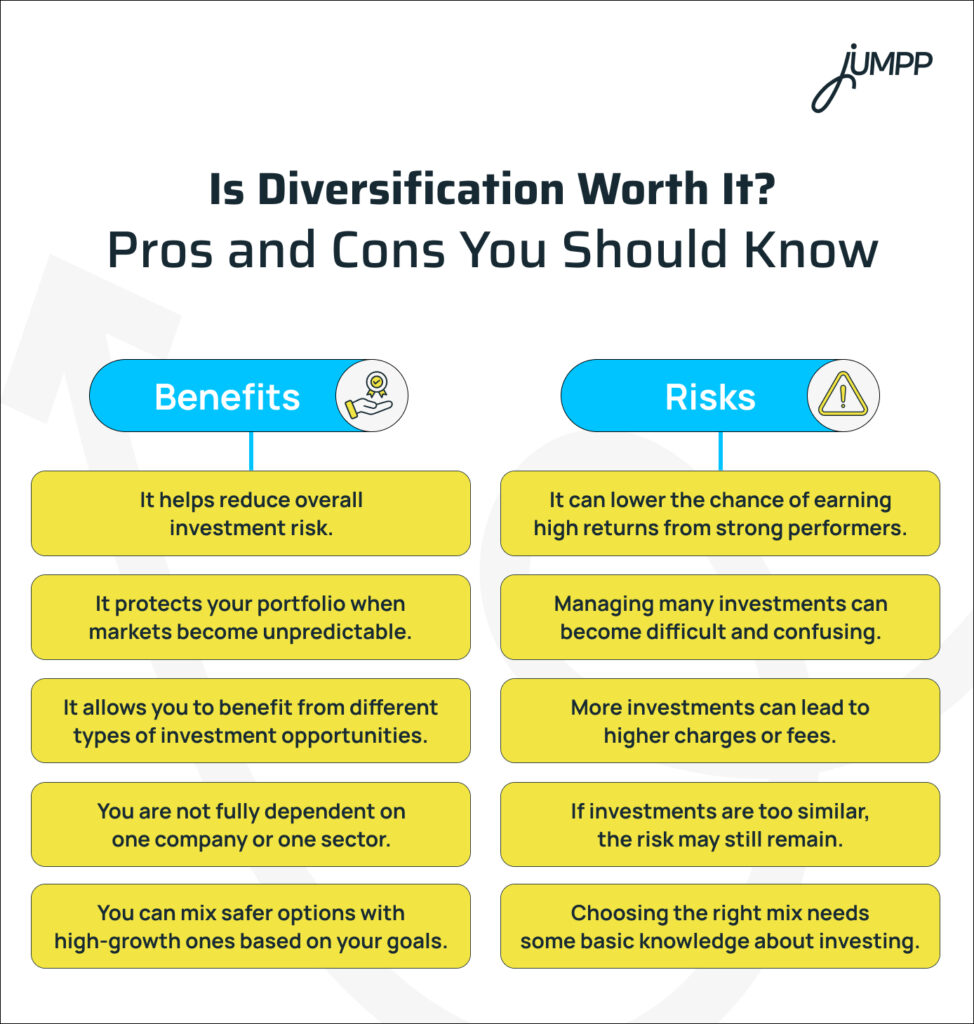

Is Diversification Worth It? Pros and Cons You Should Know

What Are the Types of Diversification Strategy?

Diversification in investing is not limited to owning many assets. It involves spreading investments across different categories so risks are balanced thoughtfully.

Here are the main types of diversification strategy:

1. Asset Class Diversification

Investing across different categories such as equity, debt, gold, real estate, and international assets.

- Equity = Growth: Stocks and equity funds aim for long-term capital appreciation.

- Debt = Income & Stability: Bonds and fixed-income instruments provide relatively steady returns.

- Gold = Hedge: Often acts as protection during inflation or market uncertainty.

2. Sector Diversification

Sector diversification means spreading investments across multiple industries rather than concentrating them in one.

- Examples in India include IT, FMCG, and Banking, each responding differently to economic cycles.

- Sector rotation helps balance performance when one industry slows down.

- Sectoral funds carry higher risk because they depend heavily on a single industry.

3. Geographic Diversification

Geographic diversification involves investing in markets outside your home country.

- Provides exposure to global growth through instruments like Nasdaq ETFs or S&P 500 index funds.

- Reduces dependence on the Indian economy alone.

- Can benefit investors during INR depreciation, as foreign assets may gain in rupee terms.

4. Market-Cap Diversification

Market-cap diversification means investing in companies of different sizes based on market capitalisation.

- Large-cap: Established companies with relatively stable performance.

- Mid-cap: Growing firms with moderate risk and growth potential.

- Small-cap: Smaller companies with higher volatility and higher potential returns.

Want to understand how market capitalization in India affects large-cap, mid-cap, and small-cap investments? Learn how company size impacts risk, returns, and portfolio diversification.

5. Risk Profile-Based Portfolio Diversification

This type focuses on balancing investments based on their underlying risk characteristics.

- Credit Risk: The risk that a bond issuer may default. Corporate bonds usually carry higher credit risk than government securities.

- Duration Risk: Longer-maturity bonds are more sensitive to interest rate changes.

- Align investments with your comfort level for volatility and capital fluctuation.

Understanding these risks helps structure a portfolio more precisely.

6. Maturity Length Diversification

Maturity diversification refers to mixing short-term and long-term fixed-income instruments.

- Short-term bonds provide liquidity and lower interest rate sensitivity.

- Long-term bonds may offer higher yields but fluctuate more with rate changes.

- Blending maturities adds flexibility during changing rate cycles.

What Is Mutual Fund Diversification?

Mutual fund diversification means spreading investments across different types of funds instead of relying on a single category.

Confused between mutual funds vs stocks while building your diversified portfolio? Understand the key differences, risks, and return potential before choosing the right investment strategy for your goals.

You can diversify across:

- Risk levels: Equity, debt, hybrid funds

- Market capitalisation: Large-cap, mid-cap, small-cap

- Geographies: Domestic and international funds

- Sectors: Banking, pharma, IT, infrastructure

This reduces the impact if one segment underperforms.

Mutual Fund Diversification Example:

- A large-cap equity fund

- A mid-cap fund

- A short-term debt fund

- A gold fund

- An international ETF-based fund

Each responds differently to economic changes. That reduces dependence on one market or sector.

Step-by-Step Diversification Strategy Using Mutual Funds

Step 1: Know Your Risk Appetite

Choose funds based on how much volatility you can tolerate.

- Conservative: Short-term debt, gold, large-cap funds

- Moderate: Mix of large-cap, mid-cap, hybrid funds

- Aggressive: Small-cap and international equity funds

Step 2: Match Funds to Goals

Time horizon matters more than returns.

- 1–3 years: Debt or liquid funds

- 3–5 years: Balanced advantage, short-term debt, gold

- 5+ years: Large-cap, mid-cap, flexi-cap equity funds

Step 3: Avoid Overlap

Do not hold multiple funds from the same category. Choose funds that behave differently in downturns

Common Mistakes in Mutual Fund Diversification

- Owning too many funds: Beyond 5–7 funds, most portfolios get messy and repetitive.

- Choosing similar fund styles: Many people invest in different AMCs, but all in large-cap schemes. That is duplication, not diversification.

- Ignoring correlation: If all your funds behave the same way in a downturn, you’re not really diversified.

The Thin Line Between Diversification and Over-Diversification

It is tempting to keep adding new funds, thinking it will reduce risk. But too much diversification can:

- Dilute your returns

- Increase the monitoring burden

- Confused allocation strategy

The goal is not to hold “everything.” It is to hold the right mix for your goals and risk level.

Diversification Meaning: FAQs

Diversification means spreading your investments or resources across different areas. It helps reduce the impact if one of them performs badly.

In business, diversification means entering new products, services, or markets. The goal is to reduce dependence on just one source of revenue.

It is the practice of dividing money or effort across different options to lower overall risk. This applies to both investing and business.

Diversification can help reduce risk, but it might also lower returns. Whether it works depends on how it’s done and for what goal.

It reduces portfolio risk, brings stable returns, and gives exposure to new opportunities. Diversification also protects during market swings.

It can dilute gains, increase tracking difficulty, and reduce focus. Too much diversification may also raise hidden costs.