Secured Loan vs Unsecured Loan: Which One Matches Your Real-Life Goals?

You’ll need a loan at some point. Maybe to grow your business or renovate your home. Maybe to fund your education. Or maybe just to handle an emergency. But before you sign those papers, there’s one basic decision to make: secured loan vs unsecured loan?

Most people go by speed. Quick approval. Zero paperwork. Instant disbursal. But smart borrowing starts with smart understanding. You need to look deeper. The difference between a secured loan and an unsecured loan is more about what’s at stake (the security you might have to give), how much you can borrow, and what it costs you in the long run.

Choosing a loan is not about what sounds easy. It is about understanding what fits your financial profile. The wrong choice can actually affect your future income and cash flows. The right one can give your finances a jump start.

In this blog, we’ll cover all the basics surrounding the difference, along with examples of secured and unsecured loans!

Two loans. Same ₹5 lakh. One charges you 9%. The other, 22%. Here’s why.

Difference Between Secured and Unsecured Loans

Same purpose. Different paths. One puts your asset on the line. The other puts your credit score.

| Basis | Secured Loan | Unsecured Loan |

| Definition | Loan backed by collateral (e.g., house, FD, vehicle) | A loan given without any collateral |

| Interest Rates | Lower interest rates due to reduced lender risk | Higher than secured loans, but can still be competitive if the credit score is good |

| Loan Amount | Higher loan amounts are possible | Moderate loan amounts offered |

| Tenure Flexibility | Longer repayment periods | Shorter repayment periods |

| Approval Chances | Easier approval if the collateral is strong | Faster processing for those with a good credit score |

| Risk to Borrower | An asset can be seized if you default | No risk to personal assets |

| Process Time | Documentation and valuation can delay disbursal | Fast disbursal |

| Credit Score Dependence | Less dependent on credit score | Heavily dependent on credit score |

| Suitable For | People needing large loans with time to repay | People needing quick, short-term funds without risking assets |

One loan asks, ‘What do you own?’ The other asks, ‘Can we trust you?’

Let’s learn more about secured loan vs unsecured loan with examples!

What is a Secured Loan? Know Before You Pledge Anything

A secured loan is backed by collateral. This means the borrower pledges an asset, such as a house, car, or fixed deposit, as security. If the borrower fails to repay, the lender has the legal right to sell the collateral and recover the outstanding dues.

Secured loan definition: A loan where the lender holds a legal claim on your asset till you repay.

Secured loans examples

- Home loan (your house is the collateral)

- Car loan (secured against the vehicle)

- Loan against property

- Gold loan

- Loan against fixed deposits or mutual funds

- Home equity loan (loan taken against the existing property value)

- Overdraft or credit line (based on property or FD value)

They help borrowers scale up without bearing high interest costs.

These loans often come with lower interest rates because the risk to the lender is reduced. In India, most long-term or high-value loans fall into this category.

Types of Secured Loans

Common secured loan examples in India include:

- Home Loan

You pledge the house you’re buying. It stays under the bank’s lien until the loan is fully repaid. - Car Loan

The car you purchase is the collateral. Miss too many EMIs, and the vehicle can be repossessed. - Loan Against Property (LAP)

You take a loan by mortgaging your home or land. - Gold Loan

You deposit your gold ornaments with the lender. It’s one of the fastest secured loan options. - Loan Against Fixed Deposit (FD)

You borrow against your FD. Interest is just slightly above the FD rate. - Home Equity Loan

A top-up loan based on your existing property’s market value. - Secured Business Loan

This is offered to businesses against equipment, property, or inventory.

What is an Unsecured Loan? Borrow on Trust, Not Assets

An unsecured loan requires no collateral. It’s purely based on your credit profile. This means your income, CIBIL score, repayment history, and stability. The risk for the lender is higher, so the interest rates tend to be higher too.

Unsecured loan definition: A loan without any pledged security, given based on your financial credibility.

Unsecured loans examples

- Personal loan

- Credit card debt

- Buy Now Pay Later (BNPL) loans

- Education loan (in some cases)

- Short-term business loans

Types of Unsecured Loans-

- Personal Loan

It is used for emergencies, weddings, travel, or education. Fast to get, but costly if your credit score is low. - Credit Card Loans

This means revolving credit. High interest. Easy to use, but risky if not managed carefully. - Buy Now Pay Later (BNPL)

These include popular for e-commerce purchases. No collateral, but late fees and penalties apply. - Education Loan (in some cases)

Many student loans, especially for smaller amounts or from public banks, are unsecured. Larger loans may require a co-signer or collateral. - Short-Term Business Loan

This is ideal for working capital or expansion. Based on the business’s cash flow and credit profile. - Medical Loan

This is used during health emergencies. Fast approval, but it often comes with higher interest.

Also, people often ask—are student loans secured or unsecured?

In India, most student loans through public banks are unsecured, especially if the loan amount is small. But for higher education loans, lenders may ask for a co-applicant or property collateral.

Unsecured loans give you a flying start, but only if you understand the terms.

Again, if you ever came across a thought and wondered, car loan is secured or unsecured? The answer is, It’s secured. The car you buy is the collateral. The same applies to a home loan, it’s always a secured loan.

Which One Should You Choose?

Now, there is no specific answer to this. The better question is, what are you borrowing for, and what do you bring to the table?

Let’s say:

- You need funds for a wedding or medical emergency, and don’t own any assets—an unsecured personal loan makes more sense.

- You’re looking to buy a house and can provide property documents—go for a secured home loan to get lower rates.

- You own gold but need instant liquidity—a gold loan is a secured option that’s quick and cheap.

- You have no credit history? Some lenders may still approve you, but only against collateral.

Get a pre-approved personal loans as soon as you sign up with jUMPP. the smart personal loan app for quick approvals and easy disbursals.

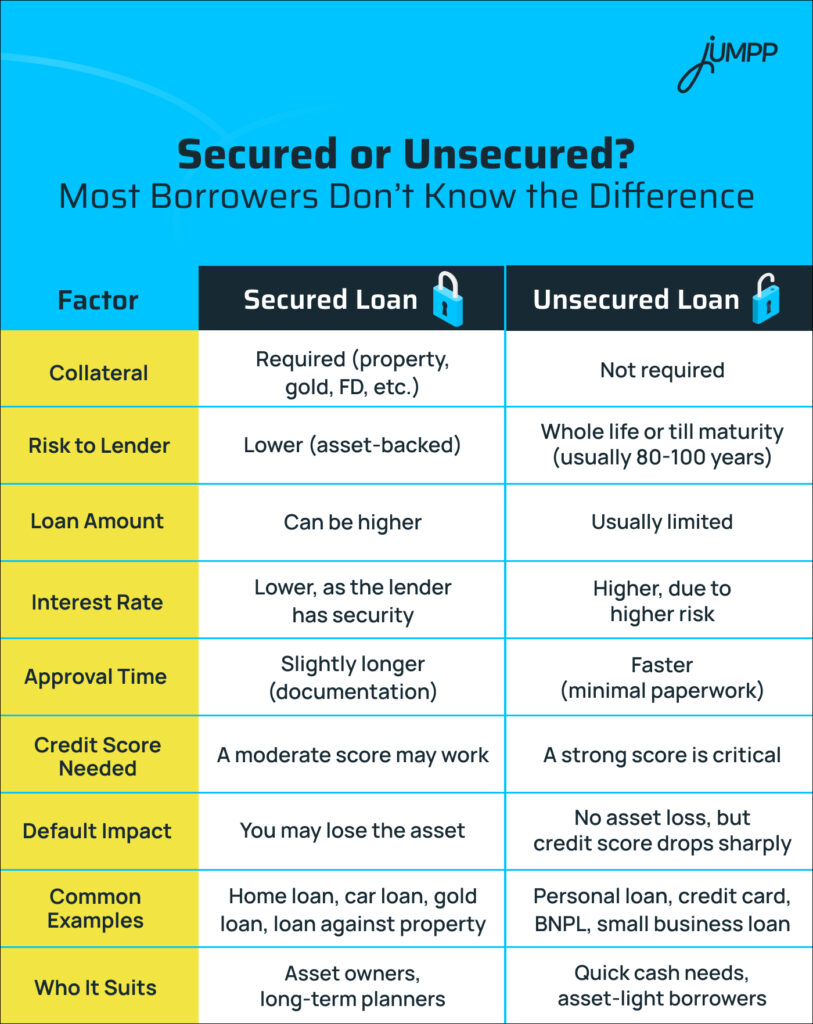

Secured or Unsecured? Most Borrowers Don’t Know the Difference

We often forget that financial literacy is not uniform. While algorithms decide eligibility, borrowers often go by what looks “easy” on an app. Without clarity, the risk of misaligned expectations rises.

If someone doesn’t understand that secured loans require ownership of an asset, they may apply blindly and get rejected—hurting their credit score. If another borrower chooses an unsecured loan without knowing it has a 20% interest rate, they may default.

That’s why responsible lending means more than approvals. It means guiding users to the right loan type with honesty.

What Do These Loans Cost You?

Here’s a quick look at typical interest rates in India across both types:

| Loan Type | Secured or Unsecured? | Interest Rate (Approx.) |

| Home Loan | Secured | 8% – 9.5% p.a. |

| Car Loan | Secured | 9% – 11% p.a. |

| Gold Loan | Secured | 7.5% – 12% p.a. |

| Loan Against FD | Secured | 6% – 8.5% p.a. |

| Personal Loan | Unsecured | 11% – 24% p.a. |

| Credit Card EMI | Unsecured | 18% – 36% p.a. |

How Each Loan Affects Your Credit Score

Every loan affects your CIBIL score. But the way it impacts depends on the loan type.

- Secured Loans

This is usually safer for first-time borrowers. If you repay on time, it builds your credit score steadily. Even if your CIBIL score is low, lenders may still approve it if the collateral is strong.

- Unsecured Loans

These are heavily credit-score dependent. Any missed EMI hits your score fast. But if managed well, it improves your credibility for future loans.

What Lenders Look For in Each Case

What lenders check before giving a loan is different for secured vs unsecured.

| Criteria | Secured Loan | Unsecured Loan |

| Collateral value | High priority | Not needed |

| CIBIL Score | Moderate weight | Critical |

| Income Proof | Required | Required |

| Loan Repayment History | Less strict | Very important |

| Co-applicant Option | Optional | Common for new borrowers |

| Loan Amount Flexibility | Higher | Linked to creditworthiness |

If you don’t have a strong credit profile, lenders will usually ask for some form of security—either an asset or a co-signer.

Final Word

Secured loans vs unsecured loans is not just a product-level difference. It’s a mindset shift for both lenders and borrowers. Understanding this helps users borrow wisely, repay on time, and build long-term financial health.

Don’t go by speed alone. You must take a leap based on what supports your long-term financial growth.

Still unsure what kind of loan fits your needs?

From supporting your education, weddings to working capital for your business, India offers many options! Now that you understand the types of loans, explore the full list of loan options available in India!

Unsecured vs Secured Loans- FAQs

There is no universally better option. The right loan depends on your collateral, credit profile, and borrowing needs.

A home loan is an example of a secured loan. A personal loan is an example of an unsecured loan.

Secured loans carry the risk of asset loss if you default. The approval process may also take longer due to documentation.

Secured loans generally have lower interest rates. They also offer higher loan amounts due to reduced lender risk.

A secured loan is backed by collateral. It could be property, fixed deposits or gold. An unsecured loan is issued based only on your creditworthiness.

A car loan is a secured loan where the vehicle acts as collateral. If the borrower defaults, the lender can repossess the car.

Secured loans are usually cheaper because lenders face less risk. Unsecured loans have higher interest rates due to no collateral.

Secured loans can be either fixed or floating rate. The type of interest rate depends on the loan product and lender terms.

A secured loan may be a suitable option if you need a higher amount and have assets to pledge. It also reduces borrowing costs.