Home Loan Process: What Borrowers Must Know Before Applying

Home loan ads talk about low interest rates, instant approvals, and fast-track processing. But no one explains what happens after that first click. Where do most applications get stuck? What documents slow down disbursement? What’s the difference between a sanction and an actual cheque in hand? If you’re applying for a home loan or just planning to, you must learn the real home loan process, step by step.

The Indian housing market has seen a structural shift over the past two decades. With increasing urbanisation, rising aspirations, and improved access to credit, home loans have become the primary instrument for property ownership for all. However, despite the penetration of housing finance, the home loan process continues to remain misunderstood.

Let’s jUMPP ahead today and learn everything about it!

Step-by-Step Home Loan Process

Home Loan Process Flowchart (Step-by-Step)

- Loan Application Submitted

→ You fill out the home loan form (online or offline) and attach basic documents. - Document Verification

→ Bank checks your ID, income proofs, property details, and credit report. - Creditworthiness Check

→ CIBIL score, repayment history, existing liabilities, and income–expense ratio are assessed. - Loan Eligibility Calculation

→ Based on income, age, profession, and property value, the bank decides how much to lend. - Loan Offer & Sanction Letter

→ If eligible, you receive a sanction letter with the loan amount, interest rate, and tenure. - Property Valuation & Legal Check

→ Bank verifies the property’s title, legal clearances, and market value. - Loan Agreement Signing

→ You accept the terms, sign the loan agreement, and submit post-dated cheques or an ECS mandate. - Disbursement of Funds

→ Loan amount is disbursed (either in full or in stages) directly to the seller or builder. - EMI Begins

→ Your EMI starts from the next month or as per the agreed schedule.

The procedure for availing a home loan involves multiple stages. These are:

Step 1: Determination of Eligibility

Before applying, most lenders assess an applicant’s housing loan eligibility based on:

- Income and repayment capacity

- Age

- Employment type (salaried/self-employed/business, etc)

- Existing liabilit

- Credit history (CIBIL score)

For example, salaried individuals in metro cities are typically eligible for loans of up to 60 times their monthly income, depending on deductions and existing EMIs. For self-employed professionals, lenders examine net profits from audited financials.

Step 2: Application Submission

After eligibility is established, the next step is to submit a formal application, either online or offline. The applicant is required to submit personal, financial, and property-related documents, including:

- PAN and Aadhaar

- Income proof (salary slips, Form 16, or ITRs)

- Address proof

- Bank statements (6–12 months)

- Property documents (agreement to sell, sanction plans)

The lender charges a processing fee, usually 0.25% to 1% of the loan amount, either upfront or post-sanction.

Step 3: Internal Credit Appraisal

This stage involves two parallel evaluations:

a. Financial Appraisal

The bank analyses:

- Income-to-loan ratio

- Stability of income (job continuity, business vintage)

- Fixed Obligations to Income Ratio (FOIR)

A FOIR above 50% generally leads to lower eligibility.

b. Credit History Assessment

CIBIL or Equifax reports are pulled to assess past repayment behaviour. A history of default or high credit utilisation can negatively impact approval.

Step 4: Property Verification

This includes:

a. Legal Verification

A lawyer from the lender’s panel examines:

- Chain of title

- Builder permissions

- Non-encumbrance

- Approved plans

- Occupancy/commencement certificate

b. Technical Valuation

An engineer/valuer from the bank inspects the property for:

- Construction status

- Quality of construction

- Area measurements

- Market valuation

This step ensures the lender is not financing disputed or overvalued properties.

Step 5: Sanction Letter

After a satisfactory internal assessment, the lender issues a sanction letter stating:

- Loan amount sanctioned

- Rate of interest (fixed/floating)

- Tenure

- EMI amount

- Validity (typically 1–3 months)

This is not a disbursal but an offer subject to final approval post property verification.

Step 6: Execution of the Loan Agreement

Once the sanction terms are accepted, the applicant must sign:

- Loan agreement

- ECS/NACH mandate for EMI deduction

- Disbursement request form

Original property documents are collected for mortgage creation. In case of an under-construction property, a tripartite agreement may be required between the buyer, the builder, and the lender.

Step 7: Home Loan Disbursement Process

This is the final stage. Disbursement can happen in one of two ways:

- Full disbursement: For ready-to-move properties

- Partial disbursement (in tranches): For under-construction properties, based on completion stages certified by the builder and verified by the bank.

Disbursement is made directly to the builder or seller, not to the borrower.

Note: Loan disbursement is subject to the successful creation of the mortgage and registration, wherever applicable.

Home Loan Processing Time in India

The entire home loan process, from application to disbursement, typically takes 8 to 20 working days, depending on:

- Lender’s internal processes

- Accuracy and completeness of documentation

- Property stage (ready vs under-construction)

- Applicant profile

Delays often occur due to incomplete legal papers, pending builder NOCs, or unregistered agreements.

How Home Loans Work in India: Structure, Regulation, and Realities

For many Indians, purchasing a home is the most significant financial decision of their life. But behind every flat booked or independent house purchased, there’s a structured and often misunderstood credit process. In India, the majority of home purchases, especially in urban and semi-urban areas, are funded through housing loans. And while banks and lenders have simplified the interface with apps and paperless KYC, the backend home loan process still remains layered.

Framework of Home Loans

A home loan is a secured credit facility where a bank or housing finance company (HFC) provides funds to an individual or joint applicants for the purchase, construction, renovation, or expansion of residential property.

In India, home loans are regulated by:

- RBI (for banks),

- NHB (for HFCs, now merged with RBI oversight).

The loan amount is secured through a mortgage on the property being purchased or constructed.

The Home Loan Disbursement Process in Practice

Once all approvals are in place, the loan agreement is signed. This is a legally binding contract, enforceable under Indian contract law. The lender takes possession of the original title documents, which are held until the entire loan is repaid.

The actual home loan disbursement process depends on the property type:

- For ready-to-move homes, the full amount is disbursed at once.

- For under-construction homes, the amount is disbursed in tranches based on progress stages. Builders must submit demand letters, which are cross-verified by the lender’s engineer before releasing each tranche.

The disbursement is made to the builder or seller’s account directly. It is never transferred to the borrower.

In many cases, especially for salaried employees purchasing from a reputed developer, the entire home loan processing time is under 10 days. For self-employed or non-standard profiles, it may take up to 3 weeks.

Home Loan Balance Transfer: A Financial Restructuring Option

The home loan balance transfer process is a refinancing tool.

Borrowers opt for it when they feel their current lender’s rate is too high, service is poor, or when additional funds are required for renovation. Borrowers already servicing a loan can opt for a home loan balance transfer to another lender offering lower interest rates.

The procedure involves:

- Obtaining a foreclosure letter and loan statement from the current lender

- Submitting the same to the new lender

- The new lender does a fresh credit and property appraisal

- On approval, the new lender repays the old loan and takes charge of the mortgage

- Borrower signs new loan agreement with revised terms

Note: Processing fees, legal charges, and stamp duty (in some states) are applicable.

The process involves getting a foreclosure letter and loan statement from the current lender. The new lender evaluates the borrower’s profile afresh. If approved, the new lender pays off the old loan and takes possession of the original documents. A new EMI schedule begins.

Borrowers must calculate savings after factoring in processing fees, legal charges, and insurance. For loans under ₹50 lakhs, even a 0.5% rate cut can result in interest savings of ₹3–5 lakhs over 20 years.

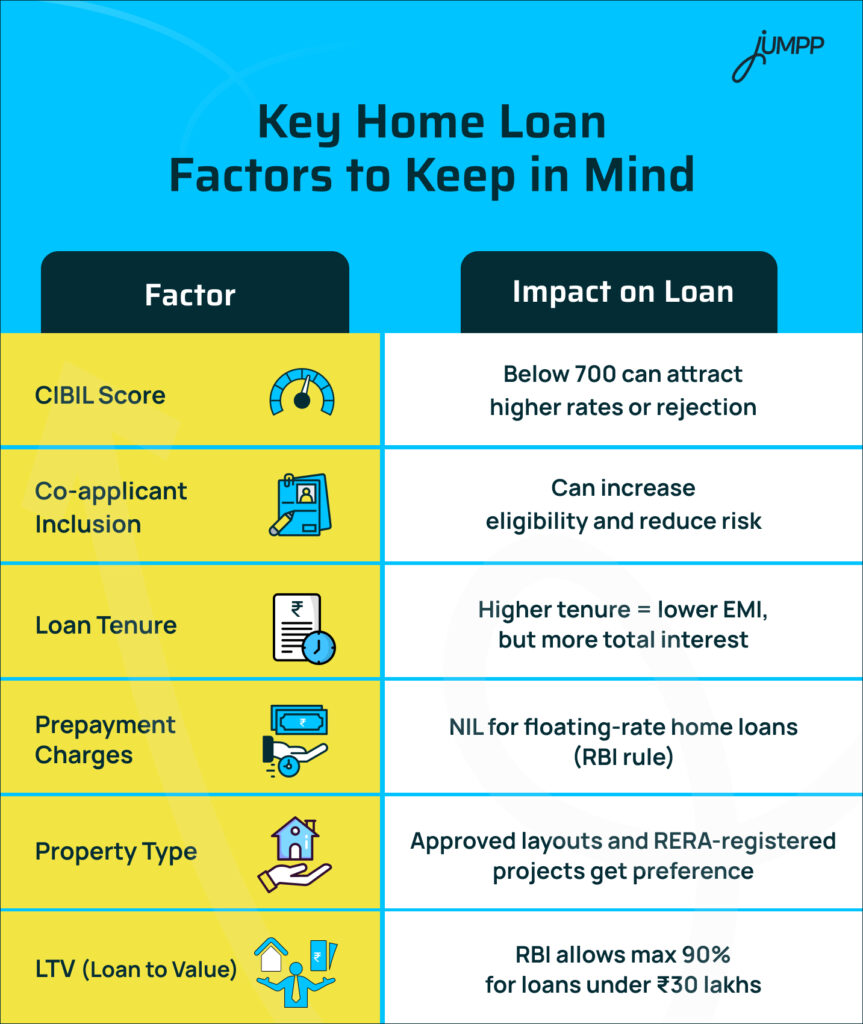

What Really Affects Your Home Loan Terms?

Borrowers often think that only income matters. In reality, multiple home loan factors affect the loan terms. These include:

- CIBIL score: Anything below 700 attracts higher scrutiny.

- Co-applicants: Adding a spouse with income improves eligibility.

- Property location: Tier 1 city homes get better valuation and approval rates.

- LTV ratio: Lenders finance up to 90% for loans under ₹30 lakhs, and 75–80% for loans above ₹75 lakhs.

- Tenure: Longer tenure reduces EMI but increases total interest.

Key Home Loan Factors to Keep in Mind

| Factor | Impact on Loan |

| CIBIL Score | Below 700 can attract higher rates or rejection |

| Co-applicant Inclusion | Can increase eligibility and reduce risk |

| Loan Tenure | Higher tenure = lower EMI, but more total interest |

| Prepayment Charges | NIL for floating-rate home loans (RBI rule) |

| Property Type | Approved layouts and RERA-registered projects get preference |

| LTV (Loan to Value) | RBI allows max 90% for loans under ₹30 lakhs |

Read More:- Types of Loans in India

Conclusion

In India, many families take loans based on emotional aspirations without understanding the complete guide to the home loan process.

A home loan is not just a means to an end. It is a legal and financial journey that spans decades. Thus, it is important to understand the home loan process step by step.

Home Loan Process: FAQs

The process includes application, document verification, credit check, loan sanction, property valuation, agreement signing, and disbursal as per bank policy.

You need to submit identity proof, income documents, bank statements, and property papers. The lender verifies these before deciding loan eligibility.

At 8.5% interest for 20 years, the EMI would be around ₹17,356 per month. Exact EMI may vary based on rate and tenure.

Banks may offer up to 90% LTV for loans below ₹30 lakh, depending on your eligibility.

With ₹60,000 monthly income, you may be eligible for ₹15–250 lakh, based on your repayment capacity, liabilities, and credit score.

No, banks in India do not offer 100% home financing. As per RBI rules, you must pay a margin of 10% to 25% from your own funds.

With ₹1 lakh salary, loan eligibility could range from ₹40–60 lakh. However, this is subject to tenure, credit history, and existing debts.

You’ll need your sanction letter, property documents, loan agreement, KYC proofs, and bank statements. Some lenders may also ask for an occupancy certificate, builder’s NOC, or payment receipts.