Bonds vs Stocks: Which One Fits Your Investment Style in 2025?

You have just started earning, and everyone around you has advice: “Put it in LIC,” “Buy mutual funds,” or “begin SIP”, But what’s right for you? Before you listen to anyone, you need to understand two basic options of the share market: stocks and bonds. These are two very different routes for your money, and knowing the basics of stocks vs bonds can help you make better decisions.

Someone might tell you stocks are risky but rewarding. Another may say that bonds are boring but dependable. But no one sits you down to walk you through how these two pillars of investing really work.

Let’s begin and learn the real difference between stocks and bonds!

What Are Stocks?

A stock represents ownership.

When you buy shares of a company, you become a part-owner of that company. You are entitled to a portion of its profits (usually in the form of dividends) and, more importantly, to its future growth. Stocks trade on exchanges (NSE and BSE), and their prices fluctuate based on company performance, investor sentiment, and broader economic trends.

Types of Stocks in India: Which One Should You Buy First?

There are various types of stocks that you can invest in!

1. Common Stock

This is the most common type you’ll hear about. If you own it, you have voting rights in the company and may get dividends (if the company decides to pay them).

But if the company shuts down, you only get paid after all debts and preferred stockholders are cleared.

Invest in stocks with open a free demat account!

2. Preferred Stock

This type of stock is more like a mix between a stock and a bond. You get fixed dividends, and if the company is facing some major losses, you’re paid before common shareholders.

But usually, you don’t get voting rights. These are less volatile and suit investors looking for regular income.

3. Growth Stocks

These belong to companies expected to grow faster than average. They might not pay dividends because profits are reinvested to expand. They have high potential returns, but also higher risk.

4. Value Stocks

These are companies trading at prices lower than what they’re actually worth. They might not be “hot” in the market right now, but they have strong fundamentals. Many long-term investors love these.

5. Income Stocks

These regularly pay dividends, giving you steady income. These types of socks are usually from established companies in stable industries.

6. Based on Company Size

- Large-cap stocks: These are offered by established companies with high market value. Safe but slower growth.

- Mid-cap stocks: These are offered by medium-sized companies, offering a balance of growth and stability.

- Small-cap stocks: Small companies with huge growth potential offer small-cap stocks.

7. Other Common Classifications

- Cyclical stocks: Prices rise and fall with the economy (like auto companies).

- Defensive stocks: Stay stable even in tough times (like FMCG companies).

- Penny stocks: Very low-priced, small company stocks — risky and speculative.

- Blue-chip stocks: Big, financially strong companies with a proven track record.

What Are Bonds?

A bond is not ownership. It is a loan.

When you buy a bond, you are lending money to a company or the government. In return, you get interest payments at a fixed rate (called the “coupon rate”) and the promise of your principal back after a fixed period.

Types of Bonds in India- From G-Secs to Corporate Bonds

Bonds in share market are classified based on several factors. Let’s explore!

1. Based on Who Issues Them

- Government Bonds: These are issued by the central or state government. In India, these are called G-Secs and are among the safest investments because the government guarantees them.

- Municipal Bonds: These bonds are issued by local authorities or state bodies to fund public projects. Some even come with tax benefits.

- Corporate Bonds: Such bonds are issued by companies to raise money. They can offer higher returns than government bonds but also carry more risk, depending on the company’s credit health.

2. Based on How Long They Last

- Short-Term Bonds: Mature in 1–3 years. These types of bonds offer lower risk but smaller returns.

- Medium-Term Bonds: Mature in 4–10 years. These bonds balance between safety and earnings.

- Long-Term Bonds: Mature after 10+ years. These bonds can give higher returns, but your money is locked in longer, and the risk is higher.

3. Based on How They Pay Interest

- Fixed-Rate Bonds: Bond interest rate stays the same until maturity, so you know exactly what you’ll earn.

- Floating-Rate Bonds: Here, the bond interest changes at regular intervals, depending on market rates.

- Zero-Coupon Bonds: These bonds are sold at a discount and don’t pay interest regularly; instead, you get the full value at maturity.

4. Other Popular Types

- Convertible Bonds: Can be converted into shares of the issuing company.

- Callable Bonds: The issuer can repay you before maturity.

- Puttable Bonds: You can sell the bond back to the issuer before maturity.

- Inflation-Linked Bonds: Interest and principal are adjusted based on inflation, helping protect your money’s value.

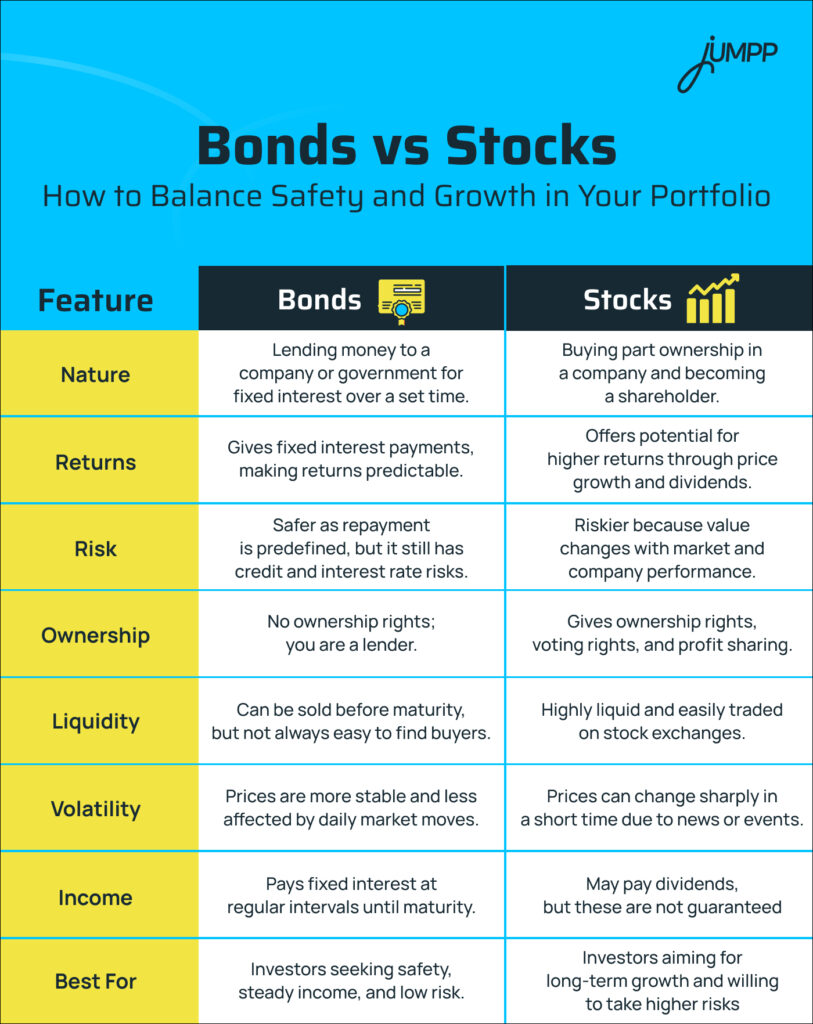

Bonds vs Stocks: Key Differences You Must Know

If you had ₹1 lakh today, would you put it in bonds for safety or in stocks for higher returns?

Let’s find out.

Are Bonds Riskier Than Stocks?

Usually, no. Bonds are seen as safer by most people because they give fixed returns and have an exact payback period. But safer doesn’t mean risk-free. If the company fails to pay back (credit risk), if interest rates go up (bond prices fall), or if inflation eats into your earnings, you can still lose out.

Stocks, on the other hand, can swing immensely in the short term. You might see big drops during a market crash. But history shows that over many years, stocks have often beaten bonds in total returns. Long-term investors who stay patient usually come out ahead.

Are Stocks Better Than Bonds?

That depends on your goals. Stocks may suit you if:

- You’re investing for the long term.

- You want to grow your wealth faster.

- You can handle market ups and downs.

Bonds may suit you if:

- You need a stable income.

- You’re near retirement or want stability.

- You value protecting your capital over chasing high growth.

For most Indian investors, the smartest choice isn’t either-or. It’s a mix of stocks for growth, bonds for stability.

How to Invest in Stocks and Bonds in India

The first and foremost step to invest in stocks and bonds is to open a free Demat account!

You can follow the steps below to begin-

- Open a Demat and trading account to hold and trade your stocks and bonds online.

- Learn the basics of how the stock market and bond market work before investing any amount.

- Decide whether you want to invest directly in individual stocks and bonds or through mutual funds and ETFs.

- Start with a small amount.

- You must diversify by mixing stocks for potential growth and bonds for stability to manage overall risk.

- It is important to keep a long-term perspective and avoid making impulsive decisions.

- Review your investments regularly to check if they are aligned with your financial goals

- Rebalance your portfolio when needed to maintain your desired stock-to-bond ratio.

Stocks vs Bonds vs Mutual Funds

In India, stocks, bonds, and mutual funds are among the most common ways people invest their savings. Whether it’s buying company shares, lending through bonds, or pooling money in mutual funds, these options are now a part of many households’ financial planning.

In case of the stocks, your returns depend on the company’s performance and stock price movements, so the risk is higher, but so is the potential reward.

Bonds are generally considered safer than stocks because they offer fixed returns, but the growth potential is lower.

Mutual funds offer diversification, which reduces risk, but returns can vary based on market conditions.

Final Thoughts

Stocks and bonds serve different purposes. One is about growth. The other is about protection. Understanding how they work and where they fit into your goals is more important than picking a side. Your father may want you to invest in fixed deposits and LIC. Your cousin might only talk about IPO listings and stocks. But now, you know enough to create a strategy that balances both.

Not sure whether bonds or stocks suit your risk appetite?

Before you decide, understand the difference between risk and return to align your investments with your financial goals.

Bonds vs Stocks- FAQs

A bond is generally more stable, giving fixed returns over a set time. A stock can be more volatile but may offer higher growth potential.

The 7% rule in stock trading is a simple way to limit losses. If a stock you bought falls by 7% from its purchase price, you sell it to prevent bigger losses with a stop loss order.

The 60:40 ratio is a classic investment approach balancing growth (stocks) and stability (bonds). Whether it suits someone or not depends on their financial goals and comfort with risk.

Stocks (equities) mean owning a share of a company and its growth potential. Bonds mean lending money to a company or government for fixed interest over time.

Stocks represent ownership in a company, where returns depend on its growth and profits. Bonds represent a loan you give to a company or government, where returns come as fixed interest, regardless of the company’s growth.