Top 10 Highest Tax Paying States in India Based on Direct Tax Collection State-wise

India’s tax story is not shaped by one sector or one city, but by states that consistently power national revenue through consumption, industry, and compliance. This detailed ranking of the top 10 highest tax-paying states in India explains tax contribution by state, income tax distribution, and the economic forces behind each state’s position.

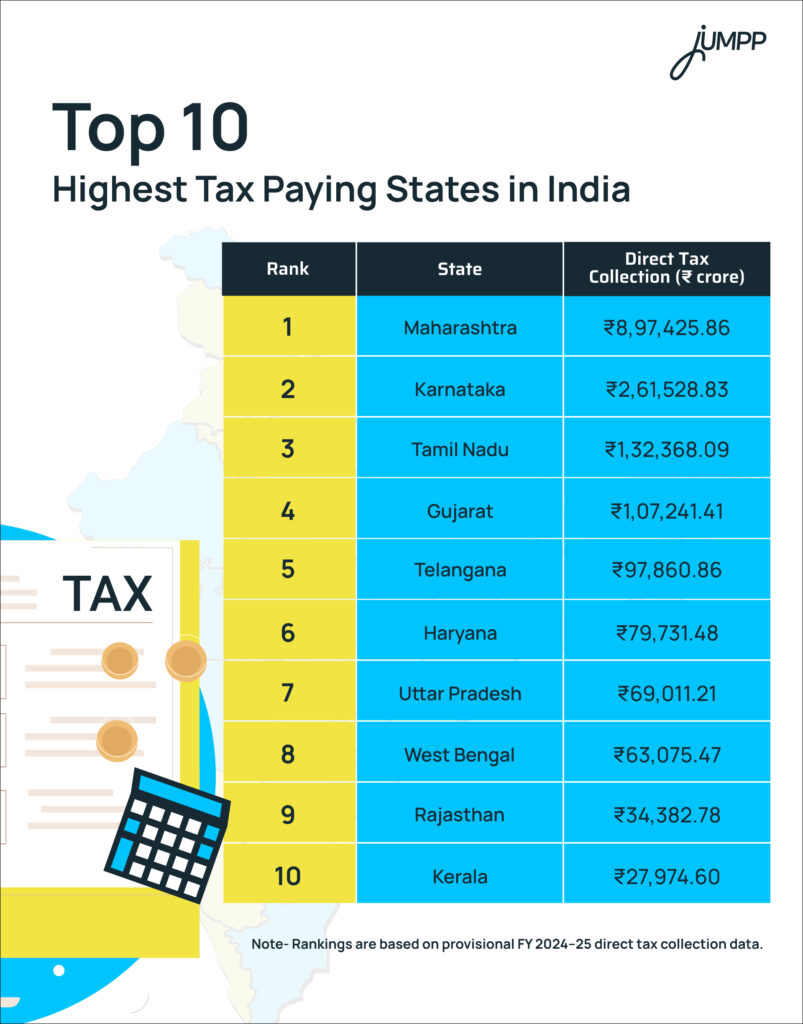

Top 10 Highest Tax Paying States in India

Source: incometaxindia.gov.in

Which State Pays the Highest Tax in India – An Overview of the Top 10 Highest Tax-Paying States

Based on direct tax collection state-wise data for FY 2024–25, the following states emerge as the top 10 highest tax-paying states in India.

This ranking reflects overall economic scale, industrial depth, consumption levels, and direct tax contribution by the states.

1. Maharashtra

GST and Tax Collection: ₹8,97,425.86 crore

Maharashtra is the highest tax-paying state in India by a wide margin. Mumbai acts as the financial capital of the country. The state hosts a large concentration of corporations and manufacturing hubs. High levels of consumer spending further strengthen its tax base. As a result, Maharashtra records the highest overall tax contribution among all states in India.

2. Karnataka

GST and Tax Collection: ₹2,61,528.83 crore

Karnataka ranks second among the highest tax-paying states in India. The state has a strong services-driven economy. Information technology, startups, biotechnology, and export-oriented businesses dominate Bengaluru.

3. Tamil Nadu

GST and Tax Collection: ₹1,32,368.09 crore

Tamil Nadu’s position is supported by a diversified industrial ecosystem. Automobiles, electronics, textiles, and engineering goods form the backbone of its economy. The state has a large manufacturing base and strong export activity.

4. Gujarat

GST and Tax Collection: ₹1,07,241.41 crore

Gujarat has a strong base in heavy industries, ports, and export-focused manufacturing. These activities play a major role in its GST contribution by state. Not only this, smooth movement of goods and a supportive business environment also help the state maintain strong tax collections.

5. Telangana

GST and Tax Collection: ₹97,860.86 crore

Telangana features prominently among the top 10 highest tax-paying states in India. This is because of rapid urbanisation and growth in technology services, pharmaceuticals, and real estate. Hyderabad’s expanding corporate and consumption base has strengthened GST revenues.

6. Haryana

GST and Tax Collection: ₹79,731.48 crore

Haryana’s high tax contribution comes from multiple sources. These include automobile manufacturing, industrial corridors, logistics hubs, and its proximity to the National Capital Region. Additionally, organised sector employment and industrial output support strong GST collection state-wise.

7. Uttar Pradesh

GST and Tax Collection: ₹69,011.21 crore

Uttar Pradesh ranks among the top contributors. This is due to its large population, rising consumption, and expanding industrial corridors. Not only this, but improved GST compliance, infrastructure development, and MSME growth have increased the overall tax base of the state.

8. West Bengal

GST and Tax Collection: ₹63,075.47 crore

West Bengal benefits from port-led trade, logistics, manufacturing, and services. Kolkata’s role as a commercial centre in eastern India supports a consistent GST contribution by the state. This is further backed by improving compliance levels.

9. Rajasthan

GST and Tax Collection: ₹34,382.78 crore

Rajasthan’s tax contribution is driven by mining, cement production, power generation, tourism, and emerging manufacturing clusters. Furthermore, renewable energy projects and mineral-based industries help expand its GST collection.

10. Kerala

GST and Tax Collection: ₹27,974.60 crore

Kerala, standing at number ten, completes the list of the top 10 GST collection states in India. Consumer spending plays a major role in GST revenue. Tourism and service-based activities add further support. High compliance levels help the state maintain steady tax inflows despite having limited heavy industry.

Top 10 GST Collection States in India

| Rank | State | Total GST Collected (₹ Crore) |

| 1 | Maharashtra | 3,59,854.70 |

| 2 | Karnataka | 1,59,563.80 |

| 3 | Gujarat | 1,36,748.21 |

| 4 | Tamil Nadu | 1,31,115.43 |

| 5 | Haryana | 1,19,362.24 |

| 6 | Uttar Pradesh | 1,12,212.23 |

| 7 | Delhi | 77,002.34 |

| 8 | West Bengal | 66,892.28 |

| 9 | Telangana | 62,986.63 |

| 10 | Odisha | 60,928.44 |

Conclusion

The direct tax paid by states’ data for FY 2024–25 clearly shows that India’s tax revenues are concentrated in a few economically strong regions. Maharashtra stands out as the highest tax-paying state in India, followed by Karnataka and Tamil Nadu, reflecting the impact of industrial depth, corporate concentration, and high consumption levels. The top 10 highest tax-paying states in India together account for a major share of the country’s tax collection.

Disclaimer– The rankings and figures in this article have been compiled from multiple verified reports, credible news sources, and public financial data available as of 2025.

All values are approximate and may vary with newer updates, revisions, or changes in official records.

Check out the top 10 richest states in India!

Top 10 Tax Paying States in India – FAQs

Maharashtra ranks as the highest tax-paying state in India, based on its highest direct tax collection among all states. Its position is driven by Mumbai’s role as the financial capital, a strong corporate presence, and high-income concentration.

Based on direct tax collection figures, the top contributors include Maharashtra, Karnataka, Tamil Nadu, Gujarat, Telangana, Haryana, Uttar Pradesh, West Bengal, Rajasthan, and Kerala.

Maharashtra shows the highest GST-linked contribution, supported by its large consumer base, corporate activity, and extensive commercial transactions.

As per the official data released, Maharashtra is the highest tax-paying state in India.

Among the top 10 highest tax-paying states listed, Kerala ranks lowest based on direct tax collection figures.

The top five highest tax-paying states in India are Maharashtra, Karnataka, Tamil Nadu, Gujarat, and Telangana.