Demand Drafts: Why They Remain a Trusted Traditional Banking Instrument

Even in a world dominated by UPI and instant transfers, there are moments when banks, universities, courts, and government offices still ask for one thing only. A demand draft. It sounds old-fashioned, yet it remains one of the most trusted payment methods in formal financial transactions. Understanding how a demand draft works can save time, prevent rejection, and avoid unnecessary bank visits.

What is a Demand Draft

A Demand Draft (DD) is a secure, bank-issued, prepaid financial instrument that guarantees payment to the recipient, as the bank collects the funds in advance. Since the bank itself issues the draft, the payment cannot bounce and is fully assured.

Demand drafts are often required during interactions with banks and government departments. The same formal systems also govern welfare schemes like the Annapurna Scheme, where understanding documentation and eligibility can make the process smoother.

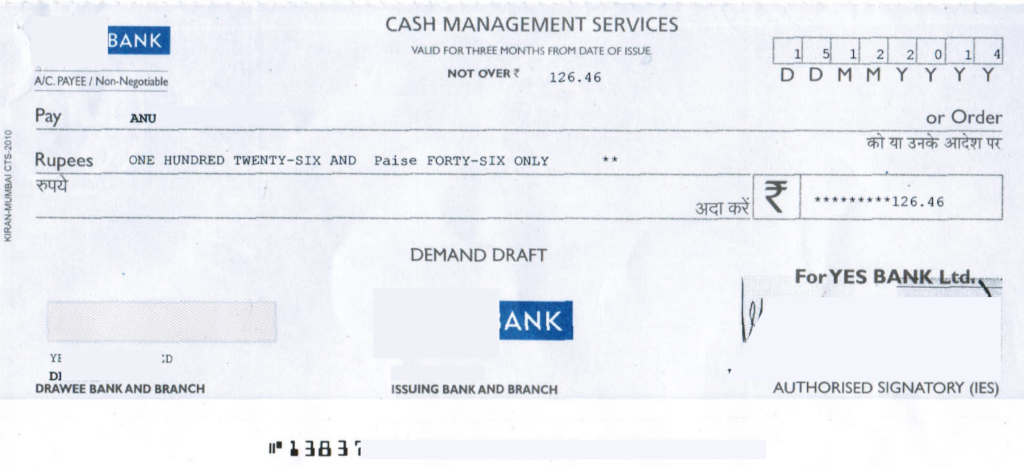

Example of Demand Draft

Here are the common details required on a DD

These details must be accurate for the draft to be accepted.

| Demand Draft Field | Description |

| To Pay | Name of the person or organisation receiving the payment |

| Date | Date on which the demand draft is issued |

| Issuing Bank Branch | The bank branch that issues the demand draft |

| Amount | Payable amount written in words |

| DD Number | Unique number used to track the demand draft |

| Bank Signature and Stamp | Official bank authorisation of the draft |

How to Find Your Demand Draft Number?

A Demand Draft (DD) number is a unique 6 to 7-digit identification number assigned to every demand draft issued by a bank. It is used for tracking the draft, processing cancellations or refunds, and verifying payments.

- Printed on the top right corner of the DD

- Mentioned at the bottom, usually near the MICR details

- Also available on the counterfoil or receipt issued by the bank

This number is required for any bank-related action concerning the DD.

Are There Any Demand Draft Charges?

Demand draft charges are fees charged by banks for issuing a prepaid and guaranteed payment instrument. The charges depend on the bank and the draft amount.

- Up to ₹10,000: flat fee of around ₹25 to ₹50

- ₹10,000 to ₹1 lakh: approximately ₹5 per ₹1,000, subject to minimum charges

- Above ₹1 lakh: around ₹4 per ₹1,000, with an upper cap that can go up to ₹2,000

- Additional charges may apply for cancellation, revalidation, or reissue

What is Demand Draft Validity?

A Demand Draft (DD) is generally valid for three months or 90 days from the date of issue, as prescribed by the Reserve Bank of India.

- Drafts not presented within the validity period become expired

- Expired demand drafts cannot be encashed directly

- Revalidation can be requested from the issuing bank

- Revalidation is usually allowed for up to another three months

This helps avoid rejection, delays, and unnecessary charges.

For widows exploring formal government processes, knowing how schemes like the Indira Gandhi National Widow Pension Scheme work can help avoid delays in accessing financial support.

Types of Demand Drafts (DD)

Demand Drafts are bank-issued payment instruments that differ based on payment timing and method of credit.

- Sight Demand Draft is payable immediately upon presentation at the bank and may require submission of specified supporting documents.

- Time Demand Draft is payable only after a fixed period or on a specified future date, often after a clearance or waiting period.

- Account Payee Demand Draft is marked “A/C Payee Only”, ensuring the amount is credited directly to the beneficiary’s bank account.

- A crossed demand draft restricts over-the-counter cash payment and allows the funds to be credited only through a bank account, similar to a crossed cheque.

How to Make a Demand Draft (DD)?

A demand draft can be issued either by visiting a bank branch or by applying through internet banking, depending on the facilities offered by your bank.

Offline Process (At the Bank Branch)

- Visit your nearest bank branch and request a demand draft application form.

- Fill in the form carefully with the payee’s name, the exact amount in words and figures, and the city or branch where the draft is payable.

- Mention your own details, including name, contact information, and account number if the payment is to be debited from your bank account.

- Provide PAN details for higher value drafts, usually above ₹50,000, and identity or address proof if the payment is made in cash.

- Submit the completed form along with the draft amount and applicable bank charges, either in cash or through account debit.

- Collect the physical demand draft and the receipt containing the unique demand draft number.

- Physically deliver the demand draft to the payee.

Online Process (Through Net Banking)

- Log in to your bank’s official website or mobile banking application using your internet banking credentials.

- Navigate to the section related to requests, payments, or demand draft issuance.

- Enter the required details, including the draft amount, payee information, and the payable branch or city.

- Choose the delivery option, either branch collection or home delivery through courier, if available.

- Review the details carefully and confirm the request, after which the amount and applicable charges will be debited from your account.

- Track the status online and collect or receive the demand draft as per the selected option.

Both methods ensure secure issuance, with online requests offering added convenience for account holders.

How to Fill a Demand Draft (DD)?

The process involves completing a simple application form and verifying the issued draft carefully.

- Enter your details as the applicant, including your name, address, bank account number if the amount is to be debited, and your signature.

- Fill in the payee or beneficiary details by writing the full name of the person or organisation receiving the payment, along with the address if required.

- Mention the exact amount to be paid, writing it clearly in both figures and words without any mismatch.

- Specify the payable location by mentioning the city or branch where the demand draft will be encashed.

- Indicate the mode of payment, whether cash or account debit, and provide PAN details for higher-value drafts as required.

- Submit the completed form along with the amount and applicable bank charges to the bank official.

- Once the demand draft is issued, verify all details such as payee name, amount, date, and payable location.

- Keep a copy of the filled application form and the issued demand draft for your records.

Accurate filling and careful verification help ensure smooth processing and acceptance of the demand draft.

What are the Documents Required for a Demand Draft (DD)?

To get a demand draft, banks usually require the following:

- A filled demand draft application form with the payee name and payable location

- The amount is mentioned clearly in words and figures

- Your basic details and bank account number if paying through account debit

- Payment of the draft amount along with applicable bank charges

- PAN details for demand drafts of ₹50,000 or more

- Valid identity or address proof if the payment is made in cash

Additional details may be requested based on the bank’s internal requirements

How to Cancel a Demand Draft (DD)?

To cancel a demand draft, a formal written request must be submitted to the issuing bank along with the original draft, provided the demand draft has not been encashed.

- Carry the original demand draft, a signed written cancellation request, and your bank account details for refund.

- If the demand draft was purchased using cash, valid identity proof may also be required.

- Address the cancellation letter to the Branch Manager and clearly mention the demand draft number, date of issue, amount, and beneficiary name.

- Visit the same bank branch where the demand draft was issued and submit the documents at the designated counter.

- Sign on the reverse side of the demand draft if instructed by the bank, and affix a revenue stamp if required.

- The bank will deduct applicable cancellation charges before processing the refund.

- The refunded amount is credited to your bank account or paid in cash, depending on the original mode of payment.

- Refund processing usually takes a few working days.

Cancelling a demand draft promptly helps avoid validity issues and ensures quicker recovery of funds.

Still confused about when to use a demand draft versus a cheque?

Understanding the difference between a cheque and a demand draft can help you choose the right payment method and avoid rejection in formal transactions.

Disclaimer– The rankings and figures in this article have been compiled from multiple verified reports, credible news sources, and public financial data available as of 2026.

All values are approximate and may vary with newer updates, revisions, or changes in official records.

Demand Draft in Bank- FAQs

A demand draft is used to make secure, guaranteed payments where the bank assures the funds on behalf of the payer. It is commonly required for official and high-value transactions.

The purpose of a demand draft is to ensure the safe transfer of money without the risk of a cheque bounce. It provides certainty of payment in formal or time-sensitive situations.

You can obtain a demand draft by applying at a bank branch or through internet banking by providing payee details and paying the amount with applicable charges. The bank issues the draft after collecting funds in advance.

A cheque is issued by an individual and can bounce due to insufficient funds, while a demand draft is issued by the bank itself. A demand draft is safer because the payment is guaranteed by the bank.

A demand draft offers guaranteed payment, higher acceptance for official purposes, and safety compared to carrying cash. It reduces the risk of rejection due to insufficient balance.

Yes, a demand draft amount is refundable if it has not been encashed. The issuing bank processes the refund after deducting applicable cancellation charges.

Demand drafts are commonly used for government fees, education-related payments, tenders, court fees, and other formal transactions. They are preferred where digital payments are not accepted.

Demand drafts involve bank charges and require physical handling and delivery. They are less convenient than digital payments and have a limited validity period.