Differences Between NEFT, RTGS and IMPS: Meaning, Charges, and Limits

We have all faced situations where UPI simply does not work for us. Sometimes it is because we have hit the daily limit. Sometimes it is because we need to send a larger amount that UPI does not allow. In all these moments, the other familiar options appear in our mind — NEFT, RTGS, and IMPS. But what is the difference between NEFT, RTGS, and IMPS?

NEFT works best for scheduled transfers, RTGS is meant for high-value real-time payments, and IMPS is the quick 24×7 option for instant money movement.

Understanding the differences between NEFT, RTGS, and IMPS helps you choose the right fund transfer method. Let’s explore the basic differences between all!

IMPS vs NEFT vs RTGS- Know Your Options Before Your Next Big Transfer

IMPS, NEFT, and RTGS are the main fund transfer systems in India.

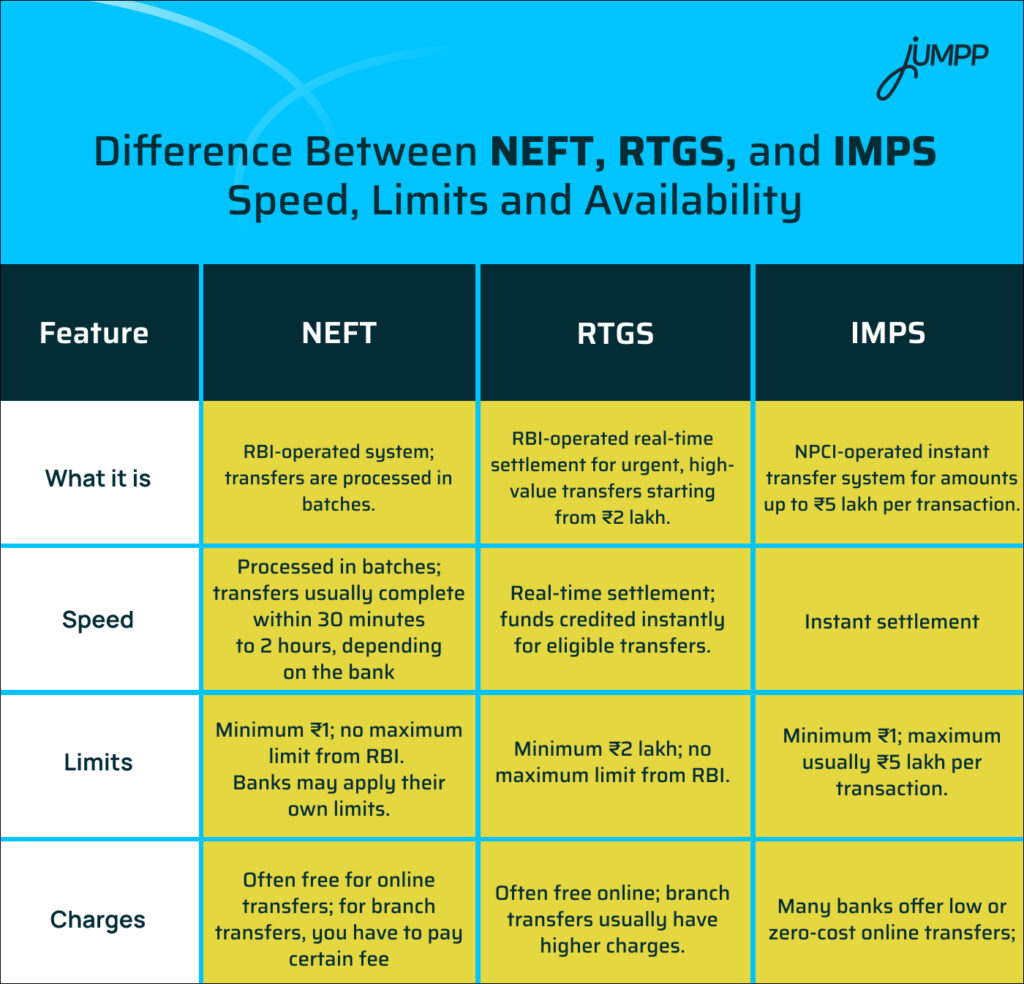

Here is the basic difference between them-

| Feature | IMPS (Immediate Payment Service) | NEFT (National Electronic Funds Transfer) | RTGS (Real-Time Gross Settlement) |

| Speed | Instant: Funds are credited to the beneficiary in real-time. | Batch-based: Processed in half-hourly batches; may take 30 minutes to 2 hours. | Real-time: Settled individually within minutes. |

| Limit | Up to ₹5 lakh per transaction (varies by bank). | No maximum limit; no minimum amount. | Minimum ₹2 lakh; no maximum limit. |

| Availability | 24/7/365, including weekends and holidays. | 24/7/365, including weekends and holidays. | 24/7/365 since Dec 2020. |

NEFT, RTGS and IMPS Timings- They are available 24/7, all days of the year.

Difference Between NEFT, RTGS, and IMPS: Speed, Limits and Availability

What is NEFT in Banking?

The full form of NEFT in banking is National Electronic Funds Transfer. It is an RBI-regulated system for secure bank-to-bank transfers in India.

How NEFT Works

The NEFT payment system works in the following manner-

- Initiation: You need to enter the beneficiary’s account number, IFSC code, and amount in your bank’s net banking or mobile app.

- Batch Processing: Banks send transaction details to the RBI, which processes them in half-hourly batches.

- Settlement: Funds are settled through deferred net settlement, then credited to the beneficiary’s account.

How to Transfer Money via NEFT

Here are the quick steps that you must follow-

- Log in to net banking or mobile banking.

- Enter beneficiary details and amount.

- Confirm and authorise with OTP.

NEFT Timings (2025 Update)

| Method | Timing | Notes |

| Online transfers | 24×7×365 | RBI update 2025: NEFT is available any time, including weekends and holidays. |

| Batch processing | Half-hourly | Transactions are processed in batches for settlement. |

NEFT Limits & Charges

| Basis | Details |

| Minimum amount | ₹1 per transaction |

| Maximum amount | No upper limit as per RBI, but banks may set their own cap |

| Charges | Often free online; branch transfers may attract small fees |

What are the Benefits of NEFT

Here is why you should opt for NEFT transfers-

- 24×7 availability for online transfers.

- Nationwide coverage connecting all participating banks.

- Secure and reliable platform for transactions.

- Versatile usage: salary, rent, EMIs, online purchases, etc.

- Accessible via net banking, mobile apps, and branches.

Who Regulates NEFT?

The Reserve Bank of India (RBI) owns and operates the NEFT system, ensuring secure and smooth interbank transfers.

What is RTGS in Banking?

The full form of RTGS in banking is Real-Time Gross Settlement.

“Real Time” means that transactions are processed immediately. “Gross Settlement” means that each fund transfer undergoes individual settlement.

- The funds are settled in the books of the Reserve Bank of India (RBI).

- This ensures the security and finality of transactions.

- RTGS is used for instant high-value transfers above ₹2 lakh.

How RTGS Works

RTGS payment mode works in the following manner-

- Provide Beneficiary Details: You need to enter the recipient’s account number, name, bank, branch, and IFSC code.

- Initiate Transaction: You have to specify the amount and authorise using your bank’s secure channel.

- Real-Time Processing: Funds are transferred immediately and settled individually in RBI books.

- Confirmation: Your bank confirms once the funds reach the beneficiary’s account, usually within 30 minutes.

What are the Different Ways to Initiate RTGS?

- Online Banking: Log in, select RTGS, enter beneficiary details, and submit.

- Mobile Banking App: You can use your bank’s app to make RTGS transfers quickly.

- Bank Branch: Fill out a form at the branch, and the staff will process the transfer for you.

RTGS Transaction Limits & Charges (2025 Update)

| Basis | Details |

| Minimum Transaction Amount | ₹2,00,000 |

| Maximum Transaction Amount | No upper ceiling set by RBI; banks may set their own cap |

| Outward Charges | ₹2–5 lakh: ≤ ₹25 (excl. tax), > ₹5 lakh: ≤ ₹50 (excl. tax) |

| Inward Transactions | Free |

| Time to Credit | Within 30 minutes |

| Failed Transactions | Returned within 1 hour or by the end of the RTGS business day |

What are the Benefits of RTGS?

Here are various reasons to choose RTGS as your mode of payment-

- 24×7 availability, including holidays.

- Instant fund transfer for high-value transactions.

- No need for cheques or drafts.

- Legal backing ensures secure, regulated transfers.

- Convenient via the internet or mobile banking.

NEFT vs RTGS – What are the Key Differences

| Feature | NEFT | RTGS |

| Processing | Batch-based; settled in half-hourly batches | Real-time; each transfer is settled instantly |

| Minimum Amount | ₹1 | ₹2 lakh |

| Maximum Amount | No upper limit (banks may cap) | No RBI limit (banks may cap) |

| Availability | 24×7 online (batch processing) | 24×7 online, instant |

Unlike NEFT, RTGS settles each transfer instantly, not in batches.

What is IMPS in Banking?

IMPS ( Immediate Payment Service) is a fast and secure way to transfer money 24/7 across banks via NPCI. It is ideal for small-value, instant transfers up to ₹5 lakh.

How IMPS Works?

IMPS method of payment works in the following manner-

- Register & Link Accounts: Both sender and receiver register with their banks and link mobile numbers to accounts.

- Initiate Transfer: Use mobile banking or internet banking; select IMPS, enter recipient details (mobile/MMID or account/IFSC) and amount.

- Authorise Transaction: Enter MPIN or net banking password to confirm.

- Receive Confirmation: Sender and receiver get instant notifications once funds are credited.

IMPS Charges & Limits (2025 Update)

| Transaction Amount | Charges (Excluding GST) |

| Up to ₹10,000 | ₹2.5 |

| ₹10,001 – ₹1,00,000 | ₹5 |

| ₹1,00,001 – ₹2,00,000 | ₹15 |

| Daily Limit | ₹5,00,000 as per NPCI guidelines; banks may set lower caps |

Availability: 24×7, all days of the year.

Transfer Speed: Funds are credited instantly upon approval.

Resolution Time: In rare cases of failures, resolution may take up to 5 working days.

What are the Benefits of IMPS

- You can do instant fund transfers anytime, anywhere.

- It offers secure transactions using MPIN, mobile number, or card PIN.

- IMPS has a wide coverage. It is supported by over 900 banks and PPI providers.

- Multiple channels: Mobile apps, internet banking, ATMs.

- It is certainly convenient for small payments: Ideal for online shopping, bills, and sending money to friends/family.

Impact of GST on NEFT, RTGS and IMPS Fees

GST applies only to the service fees charged by banks, not the money you transfer.

Here’s what that means in practice-

- What’s Taxed: Only the service or processing fee charged by the bank is taxed.

- What’s Not Taxed: The actual amount you transfer is not subject to GST.

- No Fees, No GST: If your bank does not levy a transaction fee (for example, free IMPS transfers), then no GST is charged.

| Service | Post-GST Tax Rate | Impact |

| RTGS (Real-Time Gross Settlement) | 18% (GST) | Marginal increase in transaction costs due to the higher tax rate. |

| IMPS (Immediate Payment Service) | 18% (GST) | Slight rise in charges for IMPS transactions. |

| NEFT (National Electronic Funds Transfer) | 18% (GST) | Modest increase in NEFT transaction fees as a result of GST. |

If a bank charges ₹10 for an NEFT transaction, the customer will pay ₹10 + 18% GST = ₹11.80.

Advantages and Disadvantages of NEFT, IMPS, and RTGS

Like every payment method, NEFT, RTGS, and IMPS come with their own set of advantages and disadvantages that can affect which one you choose.

| System | Pros | Cons |

| National Electronic Funds Transfer (NEFT) | – Cost-effective.- No minimum limit-High security- 24/7 availability | – Not instant- Processing delays- Dependence on batch timing |

| Real-Time Gross Settlement (RTGS) | Instant transfersNo upper limitHighly secureImmediate clearing | High minimum limitHigher chargesThe transaction cannot be reversed. |

| Immediate Payment Service (IMPS) | Instant transfers24/7 availabilityMultiple access channelsWide acceptance | Maximum transaction limitTransaction chargesDependent on the bank’s daily limit |

Want a smarter way to handle transfers and grow your savings? Try jUMPP – India’s AI-powered app for secure payments and investments!

What are Safety Tips for Online Transfers?

Before sending money, a little caution goes a long way:

- Always check the beneficiary details—name, account number, IFSC—twice, maybe even thrice. One small mistake can be painful to fix.

- Stick to your own devices and trusted networks. Public Wi-Fi and random devices are a recipe for trouble.

- Turn on two-factor authentication. That extra step may feel like a hassle, but it can save you from the unexpected.

- Keep your banking info private. No one should ever have your PIN, password, or OTP.

- Use only official apps or websites. Avoid shortcuts through third-party platforms—you don’t want surprises.

Conclusion

NEFT, RTGS, and IMPS are the backbone of India’s electronic fund transfer system. NEFT is ideal for routine, RTGS is designed for high-value, and IMPS offers instant 24×7 transfers for small to medium amounts up to ₹5 lakh.

Now, you are all set to choose the right method for every situation.

Want smooth transfers with NEFT, RTGS, and IMPS? Open a zero balance saving account online and enjoy secure banking anytime.

Source– rbi.org.in

NEFT vs RTGS vs IMPS- FAQs

Choosing the “best” service depends on your needs: IMPS is instant for small to medium amounts (up to ₹5 lakh), RTGS is for instant high-value transactions (over ₹2 lakh), while NEFT is best for non-urgent transfers of any amount, processed in batches.

RTGS is immediate, while NEFT settles in batches, not instantly.

As of July and August 2019, State Bank of India (SBI) waived online charges for NEFT, RTGS, and IMPS transactions initiated via YONO, internet banking, and mobile banking. Charges may still apply for offline branch transactions.

The minimum amount for RTGS transactions is ₹2 lakh, with no upper limit set by the RBI.

Google Pay is a Unified Payments Interface (UPI) app, which is an instant payment system built on top of IMPS, not NEFT or RTGS.

UPI is separate from NEFT and RTGS and operates as an instant payment system, primarily using IMPS for fund transfers.

NEFT (National Electronic Funds Transfer) is used to transfer funds electronically from one bank account to another across India.

NEFT processes transactions in half-hourly batches, making it suitable for smaller, non-urgent transfers. RTGS (Real-Time Gross Settlement) processes transactions in real time. It is ideal for high-value, urgent transfers.

The minimum amount for RTGS transactions is ₹2 lakh, with no upper limit set by the RBI.

NEFT is suitable for scheduled, non-urgent transfers and operates in batches, while IMPS (Immediate Payment Service) offers instant, 24×7 fund transfers, making it ideal for urgent, small-value transactions.