What is MICR Code- Digits, Format, Uses, and Benefits

With digital payments, mobile banking, and instant transfers through IMPS, NEFT, and RTGS becoming the norm, it is easy to assume that traditional banking identifiers no longer matter. But the MICR code is one term that is very important for banks. From cheque clearing to branch-level verification, the MICR number ensures speed, accuracy, and security in physical banking transactions. This article explains what the MICR code is, how it works, and how it helps banks and customers prevent fraud and processing errors.

What is MICR Code?

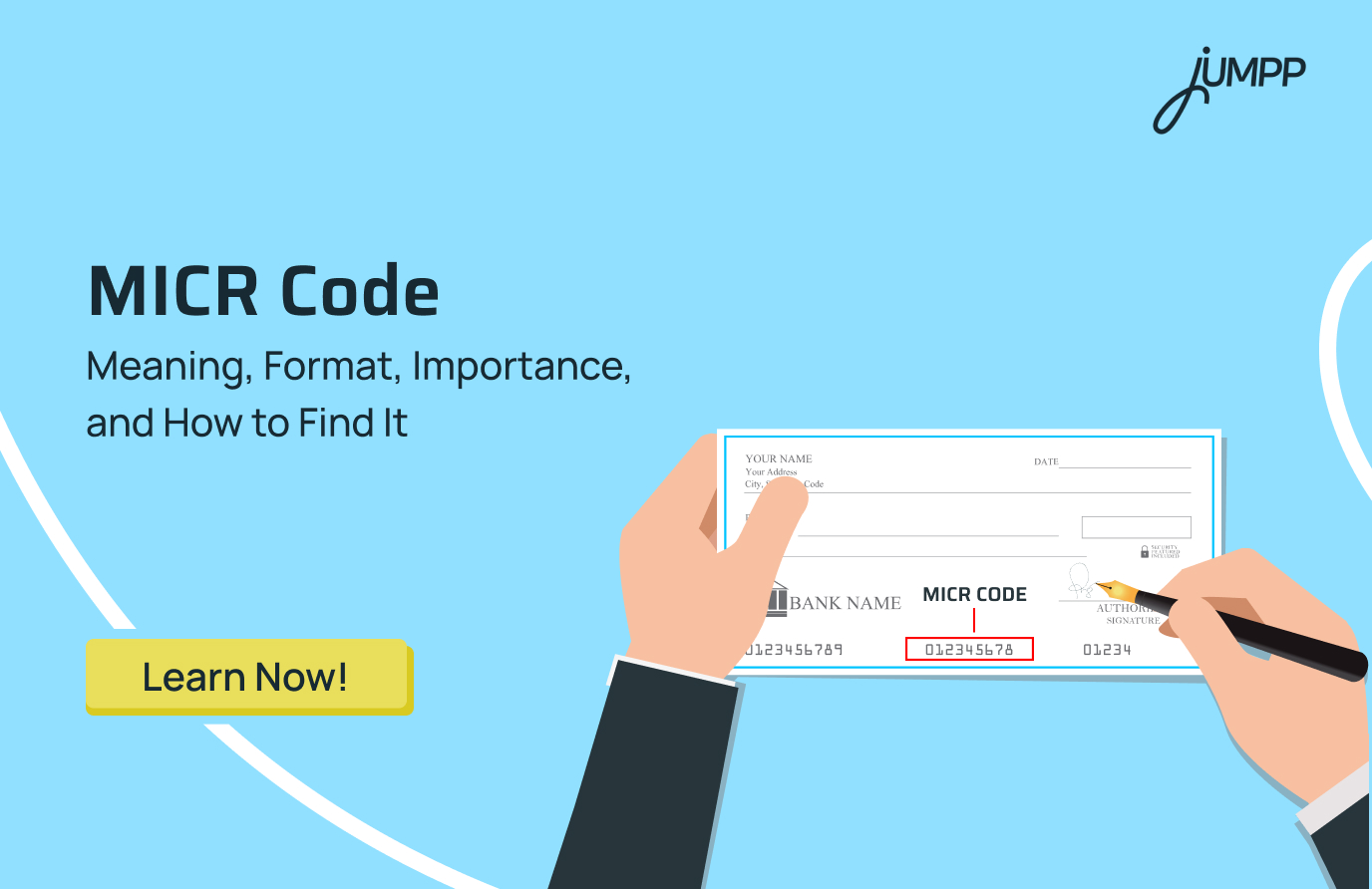

MICR code full form- Magnetic Ink Character Recognition. It is a nine-digit numeric code printed at the bottom of a cheque using magnetic ink. It uniquely identifies the city, bank, and specific branch associated with the cheque.

MICR technology allows banks to process and clear cheques quickly, accurately, and securely through automated systems.

Components of a MICR Code

A MICR code consists of 9 digits, each set serving a specific identification purpose.

- City Code (First 3 Digits)

The first three digits represent the city where the bank branch is located.

- Bank Code (Middle 3 Digits)

The middle three digits identify the bank itself. This code is assigned by the Reserve Bank of India (RBI).

- Branch Code (Last 3 Digits)

The last three digits specify the exact bank branch where the account is held.

MICR Code Format Example

If a cheque is issued from a bank branch in Chennai, a MICR code could appear as:

600 112 045

- 600 indicates the Chennai city region

- 112 identifies the issuing bank

- 045 refers to the specific branch of that bank

This combination ensures the cheque reaches the correct bank branch without manual intervention.

How to Find Your MICR Code?

Here are different places where you can find the MICR code in a bank:

| Source | Where to Look |

| Cheque Leaf | The MICR code is printed along the bottom edge of the cheque in magnetic ink, usually near the cheque number |

| Bank Passbook | Often mentioned on the first page, along with the account number and IFSC code |

| Bank Statement | Physical account statements issued by the bank may display the MICR code in the account details section |

| Net Banking Portal | Available under the account profile or branch information on the bank’s website |

| Mobile Banking App | Listed within account details or branch information in the app |

| Bank Website or Customer Support | Can be found by searching the branch details online or by contacting the bank’s customer care |

Importance of a MICR Code

MICR codes play a critical role in India’s cheque-based banking system.

- Faster Cheque Processing

MICR codes allow cheques to be read by automated sorting machines instead of being processed manually. This significantly reduces the time taken for cheque clearing and speeds up settlement between banks.

Know the difference between a cheque and a draft!

- Higher Accuracy

Because MICR codes are machine-readable, the risk of human error during data entry is greatly reduced. This ensures that cheque details such as branch and bank information are recorded correctly every time.

- Improved Security

MICR codes are printed using special magnetic ink, which is difficult to alter or replicate. This makes cheque tampering and counterfeiting far more challenging.

- Strong Fraud Control

By uniquely identifying the city, bank, and branch, MICR codes help banks verify the authenticity of cheques. Suspicious or mismatched instruments can be flagged early in the clearing process.

- Uniform Banking Standard

MICR provides a standardised system followed by all banks. This uniformity allows cheques issued by one bank to be processed smoothly by another.

- Supports Automated Clearing Systems

Beyond cheque clearing, MICR codes are also used in systems such as Electronic Clearing Service and Automated Clearing House, helping process bulk and recurring payments efficiently.

IFSC vs MICR: Why Two Codes Exist for One Bank Account

MICR and IFSC do not serve the same purpose.

MICR codes are used for processing physical, paper-based instruments such as cheques, demand drafts, and pay orders. IFSC codes are used for electronic fund transfers like NEFT, RTGS, and IMPS, enabling digital routing of money between bank accounts.

Difference Between IFSC Code and MICR Code

| Feature | IFSC Code | MICR Code |

| Full Form | Indian Financial System Code | Magnetic Ink Character Recognition |

| Code Length | 11 characters | 9 digits |

| Code Type | Alphanumeric | Numeric |

| Primary Use | Electronic fund transfers | Physical cheque processing |

| Used For | NEFT, RTGS, IMPS | Cheques, demand drafts, pay orders |

| Structure | First 4 characters identify the bank, the 5th character is zero, and the last 6 characters identify the branch | First 3 digits identify the city, next 3 identify the bank, and last 3 identify the branch |

| Transaction Mode | Digital and online payments | Paper-based banking instruments |

| Where It Appears | Bank passbooks, cheque leaves, and online banking portals | Printed at the bottom of cheques using magnetic ink |

Conclusion

As long as paper-based banking instruments continue to exist, the MICR code will remain a critical part of the banking system. While traditional banking systems continue to play a vital role, artificial intelligence is redefining how banks operate at scale. Discover how AI in banking is shaping faster decisions, stronger fraud prevention, and smarter financial services.

Disclaimer– The rankings and figures in this article have been compiled from multiple verified reports, credible news sources, and public financial data available as of 2026.

All values are approximate and may vary with newer updates, revisions, or changes in official records.

What is MICR Code – FAQs

A MICR code is a nine-digit numeric code printed on cheques that identifies the bank, branch, and city. It is used to enable fast and accurate processing of cheque-based transactions.

MICR is used for processing physical cheques and other paper-based banking instruments. IFSC is different and is used for electronic fund transfers such as NEFT, RTGS, and IMPS.

Yes, all banks that issue cheques in India use MICR codes as part of the standard cheque clearing system. It ensures uniform and secure processing across banks.

You can find the MICR code at the bottom of your cheque, printed in magnetic ink. It is also available in your bank passbook, account statement, or net banking portal.

A nine-digit MICR number uniquely identifies the city, bank, and branch linked to a cheque. It allows banks to route and clear cheques automatically without manual intervention.

Your MICR number is printed on your cheque leaf and is also visible in your bank’s mobile app or net banking account details. You can also obtain it by contacting your bank branch.

A MICR number is used to process and clear cheques quickly and securely. It helps reduce errors, prevent fraud, and ensure accurate settlement between banks.